[image-caption title="Data%20centers%20continue%20to%20proliferate%20across%20the%20country%2C%20fed%20by%20the%20growth%20of%20artificial%20intelligence%2C%20which%20requires%20significantly%20more%20computing%20power%20than%20other%20internet%20transactions%2C%20and%20the%20seemingly%20inexhaustible%20desire%20for%20more%20online%20entertainment%2C%20commerce%20and%20information.%20(Photo%20Courtesy%3A%20Equinix)" description="%20" image="%2Fremagazine%2Farticles%2FPublishingImages%2Fdec2025-datacenters-main.jpg" /]

Cole Price figures he spends about 40% of his time on data centers these days, compared to “maybe 5 to 10%" just a few years ago.

“And that's just me," he says. “Other teams spend that much time or more."

Price is executive vice president for member services at Central Electric Power Cooperative, a generation and transmission co-op based in Columbia, South Carolina, that currently provides power to one large data center, has reached deals with two more and has fielded dozens of inquiries from others.

“These projects can offer tremendous benefits to co-ops and their members," Price says. “We know from experience that adding a data center to our system can reduce the fixed cost burden on everyday co-op members. Our job is to help our co-ops achieve those benefits while protecting their members from risk.

We have been focused on how to do that for a while now, and we are constantly refining our policies and practices as we learn more."

As of early 2025, there were around 5,400 data centers in the United States. And they continue to proliferate, fed by the growth of artificial intelligence, which requires significantly more computing power than other internet transactions, and the seemingly inexhaustible desire for more online entertainment, commerce and information.

Nearly every state in the nation has data centers, with Virginia, Georgia, Texas and California among those where these facilities, often bunched along fiber backbones that can carry heavy internet traffic, are clustered.

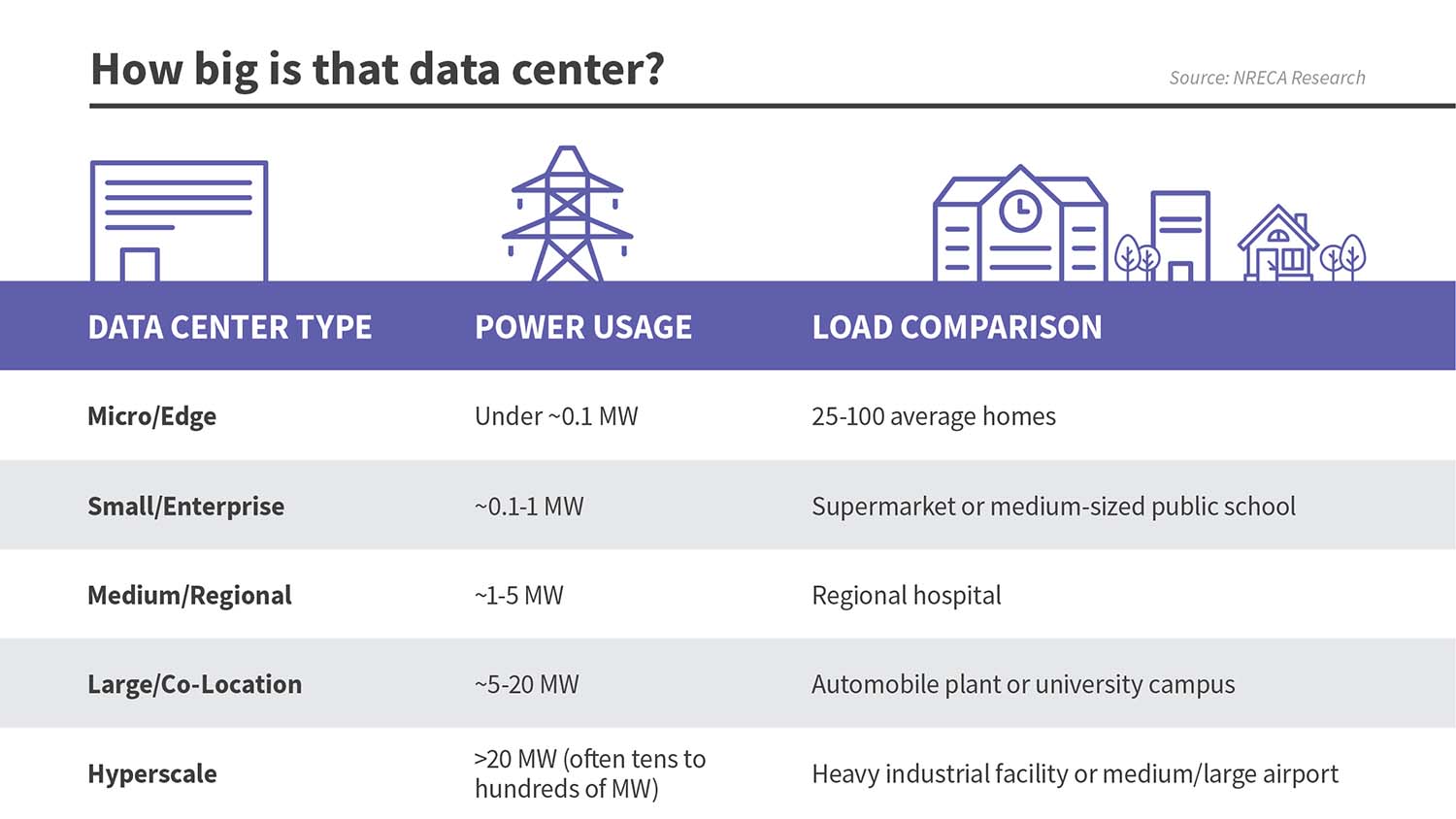

They require large amounts of power to operate servers and cooling systems, with some hyperscale data centers, as the largest are known, drawing as much as a gigawatt of electricity.

The impact is being felt across the grid. After more than a decade of relatively flat demand, peak demand is forecast to rise by 151 gigawatts from 2025 through 2034, a 17% increase, according to the North American Electric Reliability Corp. NERC attributes much of this accelerating growth to demand from data centers and other large commercial and industrial loads.

“The data center trend is impacting co-ops across the board, whether a facility is located in their territory or not," says Allison Hamilton, NRECA markets & rates director. “This wave of new large loads has the potential to transform the entire industry, and co-ops and G&Ts are drawing on their member-focused mission and community values to capture the benefits while mitigating the risks."

Why do data centers need so much electricity? Why are they expanding so dramatically? How are cooperatives working to serve them while assuring the cost of meeting their requirements doesn't impact other members? The answers start with a look inside a typical data center.

Tens of thousands of servers

Row upon row of metal cabinets with blinking lights, separated by aisles that provide room for maintenance and cooling. That's the digital heart of a data center.

The cabinets hold racks of computer servers, net-worked to manage vast amounts of data and provide everything from streaming and AI to cloud computing, storage, e-commerce and cryptocurrency mining.

Data centers come in many sizes, but hyperscale centers can be massive, running more than a million square feet, or nearly 23 acres, and filled with tens of thousands of servers.

That much computing not only draws a lot of power; it also generates a lot of heat, and centers use various types of cooling systems to handle it. Some rely on air cooling, configuring the servers in alternating rows, with cold air intakes facing one way and hot air vents facing the other. This creates hot and cold corridors that, aided by fans, provide naturally cooling air flow.

[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Other centers rely on evaporative coolers, which blow moist, cold air. More heat-intensive servers use liquid cooling. Some of the most advanced systems place “cold plates" filled with coolant directly on top of computer components to draw heat away.

According to an EPRI study, the greatest surge in power demand from data centers is coming from AI, which can require 10 times as much electricity per inquiry as a traditional Google search. And use of AI is growing rapidly, becoming ubiquitous not only for internet searches and responses but in the internal operations of businesses.

As IT companies rush to meet the demand, electric cooperatives are adjusting to the priorities of these new members and meeting the challenges of serving their unique needs.

'Timing and speed'

What's the top priority when a company comes to a co-op looking to site a data center in their service territory? For Greystone Power Corp., a distribution co-op based in Hiram, Georgia, the answer is speed.

“They definitely want to know how quickly we can meet their ramp-up schedule," says Creighton Batrouney, Greystone Power's executive vice president of power supply. “Timing and speed to market is probably the No. 1 concern."

Greystone Power serves two smaller data centers with loads of 8 and 20 megawatts. But it has three coming online in the next two years that are much larger: 85, 180 and 240 megawatts respectively.

“AI workloads are driving the size of the data centers and the number of data centers," Batrouney says.

[blockquote right quote="%E2%80%9CThis%20wave%20of%20new%20large%20loads%20has%20the%20potential%20to%20transform%20the%20entire%20industry%2C%20and%20co-ops%20and%20G%26Ts%20are%20drawing%20on%20their%20member-focused%20mission%20and%20community%20values%20to%20capture%20the%20benefits%20while%20mitigating%20the%20risks.%E2%80%9D" author="Allison%20Hamilton%2C%20NRECA%20markets%20%26%20rates%20director" align="left" /]

The co-op's service territory covers portions of eight metropolitan Atlanta counties. The Atlanta region is the second-largest data center hub in the United States and the industry's hottest market since 2023, according to analysis by CBRE, a commercial real estate firm. This growth has been fed by access to four essentials for data centers: power, land, a sturdy fiber-optic backbone and water for cooling.

For cooperatives, these projects can bring benefits that go well beyond electricity sales. The size of data center loads often necessitates transmission and distribution system upgrades, which can contribute to reliability across the board.

Greystone has worked with Georgia Transmission Corp., the Tucker-based transmission co-op owned by 38 member distribution co-ops, on system upgrades, many of which are paid for upfront by the data centers, with GTC assisting with construction and design.

“They're essentially paying their share of the cost for these transmission upgrades," Batrouney says.

Other potential advantages include improved systemwide load factor, smoothing out peaks and valleys and making the overall system more efficient. The predictable, around-the-clock nature of these loads can also create steadier revenues and support more stable rates for the entire membership. These projects can also bring new tax base, jobs and investment, often attracting additional businesses that want to locate near the facility.

“If co-ops take the time to understand and manage the challenges on the front end—whether it's infrastructure upgrades, rate design or contract terms—there can be significant upsides once the load comes online," Hamilton says. “Co-ops are uniquely positioned for this work. Their commitment to serving all members, not just the large load, means they approach these projects with care, collaboration and a focus on long-term community benefit."

'Stick to your process'

The first data center to come to one of Central Electric Power Cooperative's member co-ops arrived way back in 2007.

“It's not what you see today," says Price. “It was a lot smaller."

The next didn't come under contract until 2024, after nearly two years of weekly talks and negotiations in what Price called the “old-fashioned approach to interconnection and engineering" based on standard service requests and long lead times.

Around that time, a third data center requested interconnection. A Central member cooperative inked a deal with that facility after six months of study and negotiation.

“Our process has improved a lot over the past few years," Price says, noting their tightened timelines and new cost structure agreements. “We know what questions to ask. We know what they need from us, and we know what we need from them."

On the heels of those project announcements, other data centers began reaching out to Central and its member cooperatives.

“Different groups wanted to ride the coattails of those big providers," Price says. “They see filings at the Public Service Commission for large transmission service requests and say, 'Can we get any of the extra capacity?'"

[section separator="true"]

[section-item 6]

[row]

[column 10]

Central buys wholesale power from Santee Cooper, South Carolina's state-run utility, as well as Duke Energy. When a data center comes calling, they coordinate closely with their generation providers on capacity needs and planning. Their goal is to encourage responsible growth without putting affordability and reliability at risk.

[/column]

[/row]

[/section-item]

[section-item 6]

[row]

[column 12]

[image-caption title="Photo%20Courtesy%3A%20Equinix" description="%20" image="%2Fremagazine%2Farticles%2FPublishingImages%2Fdec2025-datacenters-2.jpg" /]

[/column]

[/row]

[/section-item]

[/section]

“We're trying to shore up resources for the next few years, to maintain reserves as larger system investments come to fruition," Price says.

Central, whose member territories sit near the terminus of major undersea fiber cables, estimates by the end of the decade, they'll likely have at least 2 GW of data center load on their system.

Price's top piece of advice for co-ops negotiating with data centers is “stick to your process."

“Develop a formal process and follow it," he says.

“That process is there for a reason: to maximize benefits and minimize risk. Do not let anyone push you out of that."

Central's process is for the member services and engineering groups to engage right away after a member co-op is contacted by a data center. First, a deposit is collected and a 30-to-60-day initial study—which the data center pays for—is conducted to determine scope and overall needs. The client then has 30 days to decide if they want to go forward with a more detailed FEED (front-end engineering design) study, which they also pay for. Agreements for energy sales and construction are then drawn up, and if the project moves forward after the completion of the FEED study, work on the data center and any electrical infrastructure upgrades can begin.

“We try to communicate transparently throughout the process," Price says. “We may come back after the initial conversation and say, 'Save your money on the study; we know we won't be able to meet your timeline.'"

Price's second piece of advice is to “put your risk tolerance on paper."

Risks can range from stranded assets and other cost recovery issues if a data center ceases operations early to supply chain issues to interconnection delays.

“Know what that tolerance is at the local level and at the G&T level," he says. “Both the upfront risk and the long-term risk."

Price's third rule is transparency—with the data centers, with member co-ops and with the public.

“The more transparent you can be—and each jurisdiction is different—the better the partnerships you'll have."

Price says by and large, his interactions with data center representatives have been positive.

“We've probably talked to over 100 developers," he says. “Some of the smaller ones can be less than transparent, but the big ones, I've had good experiences with them. They know what they want, and they are serious about not becoming a detriment in the communities that they operate in."

He says Central works to be realistic about the challenges of this new load while capitalizing on the benefits.

“Large data centers won't necessarily land in all 19 of our co-op service territories," Price said. “But all 19 co-ops will benefit directly or indirectly regardless of where the data centers locate. These are opportunities for our co-ops to improve their systems, benefit from economies of scale, get higher load factors and enhance grid efficiency."

'They really like dealing with co-ops'

East Kentucky Power Cooperative, a G&T with 16 member co-ops based in Winchester, Kentucky, is also managing a flood of contacts from data centers.

“We get called almost daily," says Don Mosier, EKPC's executive vice president and chief operating officer.

They're drawn to the region by low electrical rates but also its generation infrastructure, he says. EKPC is planning an additional 1,100 megawatts of generation over the next decade, Mosier says.

The G&T proposed a special data center tariff, which the Kentucky Public Service Commission recently approved, that requires data centers to pay the upfront costs for generation and transmission upgrades and includes a fee for studies to determine interconnection costs.

“Data centers will provide the infrastructure enabling the next era of progress in science, technology, productivity, communications and even national security," says EKPC President & CEO Tony Campbell.

“This tariff ensures all cooperative members are treated fairly when data centers are developed in Kentucky and consume large amounts of electricity."

Among other facets, the tariff applies to data centers with more than 15 MW of load, ensures data centers bear the cost of new infrastructure dedicated to their service and requires developers of data center projects exceeding 250 megawatts to provide a power supply plan.

“The tariff identifies all the costs that a data center would uniquely cause to occur and makes sure those are incurred within the data center class," says EKPC General Counsel David Samford.

Mosier says data center developers are generally on board with measures that insulate other co-op members.

“They're very keen on getting these facilities up and running as fast as possible," he says. “And they really like dealing with co-ops. They say we're much easier to work with than IOUs, because we make decisions quicker."

Related Content