The pitch sounded too good to be true.

A consumer-member of Polk-Burnett Electric Cooperative got a call from someone claiming to be from the co-op. The caller told her she’d overpaid on her utility bill, and to get the refund she was due, she’d need to provide her financial information.

It’s an innovation by fraudsters that flips the script on the typical utility scam.

“Instead of threatening members with disconnection for nonpayment, this claims the member overpaid and is being contacted for being a good member,” says Joan O’ Fallon, director of communications at the co-op headquartered in Centuria, Wisconsin.

For scammers, it’s all about offering an incentive and creating a sense of urgency.

“They’re savvy, and their pitches are so believable that victims feel pressured, rushed and convinced that they’re the real deal,” says Monica Martinez, executive director of Utilities United Against Scams (UUAS), a consortium of more than 150 utilities and their respective trade associations. “There are many ways to do this, and scammers are changing their methods all the time.”

Luckily, the Polk-Burnett EC member wasn’t fooled.

“[She] called us to confirm her suspicion and to let us know so that we could warn others,” O’Fallon says.

The co-op used multiple communication channels to alert its members of the new scam.

“Whenever we hear about phone scams, we get a warning out immediately, first to employees and then to our members and community on social networking sites, which are the fastest and most direct way to make people aware,” she says. “I don’t know if our efforts squashed this scam in particular, but it sure makes it more difficult for the criminals when word gets out on social media.”

Abby Bell, a communications specialist at Cloverland Electric Cooperative in Sault Ste. Marie, Michigan, says the scams they see are almost always structured to prey on their most vulnerable consumers.

“Sadly, our older members seem to be specifically targeted,” she says. “Over the past two years, callers have demanded immediate payment, threatened to shut off service or offered rewards to members for loyalty. They change tactics every few months. They’re pretty intelligent.”

'More and more sophisticated'

Lately, utility scammers are adapting their tactics to capitalize on consumer vulnerabilities created by the COVID-19 pandemic, mainly a surge in Americans’ dependence on internet communications for things like school, work and commerce.

“People are changing their habits and are more willing to use technology to do more things like online banking,” Martinez says. “And with that comes technology that makes scammers more and more sophisticated. Add the confusion and concerns around shifts in the economy stemming from the crisis,” and it’s a breeding ground for scams.

Martinez says the more immediate nature of internet transactions can sometimes cloud the judgment of a potential victim.

“During a phone call, it’s easier to have those opportunities to stop, wait and verify,” she says. “Doing things more remotely removes those points to stop and pause. Before, it was, ‘Go to the store and purchase a gift card and call back.’ We’ve heard instances where the scammer was helping the person on the phone download an app and telling them how to pay.”

Scammers are also increasing their use of social media to expand their reach.

“It’s easy to manufacture a fake persona, or scammers can hack into an existing profile to get ‘friends’ to con,” according to a recent report from the Federal Trade Commission.

Fraud spike

Martinez says it’s hard to know if scams specific to utilities rose during the pandemic, and the actual number is unknown because victims “often can’t believe they fell for a scam and don’t want others to know.”

However, FTC numbers show that consumer fraud in general did spike during the past two years.

[section]

[section-item]

[row]

[column 6]

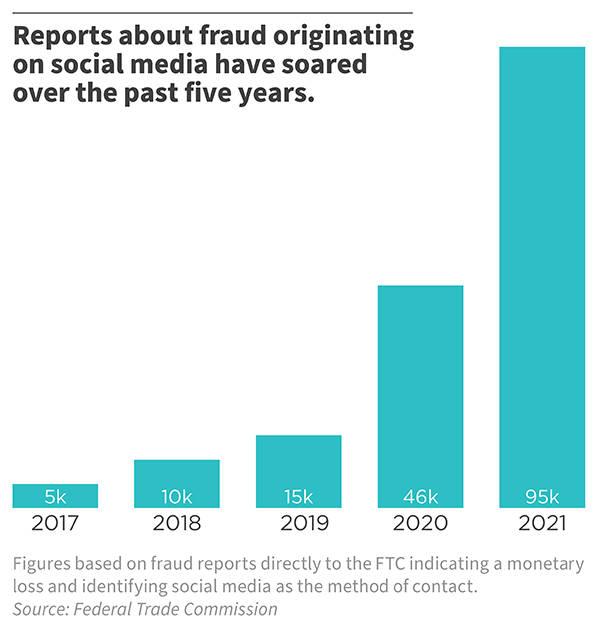

In 2021, about one-fourth of all reported fraud losses stemmed from scams originating on social media; $770 million in total losses, which is an 18-fold increase from 2017, according to the agency’s latest Consumer Protection Data Spotlight report. Of those who reported losing money to fraud in 2021, more than 95,000 indicated they were first contacted on social media—more than twice the 2020 number.

[/column]

[column 6]

[/column]

[/row]

[/section-item]

[/section]

Impersonation fraud, like the one the Polk-Burnett EC member confronted, has cost consumers billions, according to the FTC. Between October 2020 and September 2021, losses surged 85% year over year, with many scams capitalizing on COVID-19 confusion and concern.

Online fraudsters often go to great lengths to conceal their identity.

In Wyoming, a member of Powder River Energy Corp. recently reported an email from a sham power provider trying to lure a member into paying to switch their electric company.

The co-op’s cybersecurity team was able to track the email’s domain to a business in Dublin, Ohio, and the originating company to a posh address in Sunrise, Florida.

“From what they could tell, the company was at a residence with a very nice pool,” says Tim Velder, a marketing communication specialist at the Sundance, Wyoming-based co-op. “It was just sort of interesting how they looked at it and what they found.”

The pandemic also has boosted the popularity of online payment systems like PayPal, Cash App and Zelle. But as always, the conveniences that those apps offer have downsides.

Scammers will often demand payment through those platforms, but while the companies have processes for reporting a potential fraud, “it doesn’t always mean that when you make a report, you will be refunded your money,” Martinez says.

Even worse, she says, person-to-person transactions “happen instantaneously, and they often cannot be canceled.”

“When I look into the future, that will be something we’ll have to address: how to work with these new partners to educate them about the utility scams that are happening on their systems,” Martinez says.

SOMOS, the entity that manages 800 numbers in the U.S., tracks when toll-free numbers are used fraudulently. They often work with UUAS to combat scams, and their collaboration has shut down more than 12,000 numbers since 2017.

Catherine Palcic, the company’s head of strategic relations, industry relations and public policy, says 800-number scams reported by utilities spiked in 2019 but have fallen steadily since. That may be a more a function of utilities making up a smaller percentage of reports, she notes.

“We can’t necessarily attribute that to a decrease in scam activity as much as we can say that we had a lot more people and a lot more companies reporting to us,” Palcic says.

Martinez says electric co-ops are particularly effective at shutting down scams because of their good reputation with local media and community members.

A knowledgeable consumer, she says, is the best way to fight fraud.

“No one knows when or how a scammer will appear,” she says. “So it’s important for utility customers to understand the types of threats that are out there and to remember that we all could be targeted at any time.”