[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Rural bankers’ longer-term confidence in the economy has hit its lowest point in the nearly 18-year history of the

Rural Mainstreet Index monthly survey.

This month’s confidence index, which reflects bankers’ six-month economic outlook, sank to a record low of 21.2 from 24.2 in October. In the survey of rural bankers in 10 states, the index ranges from 0 to 100 with a reading of 50.0 representing growth-neutral.

“Higher interest rates, deposit outflows and a slowing farm economy over the past several months continued to constrain the business confidence index,” said study author Ernie Goss, a business professor at Creighton University in Omaha, Nebraska.

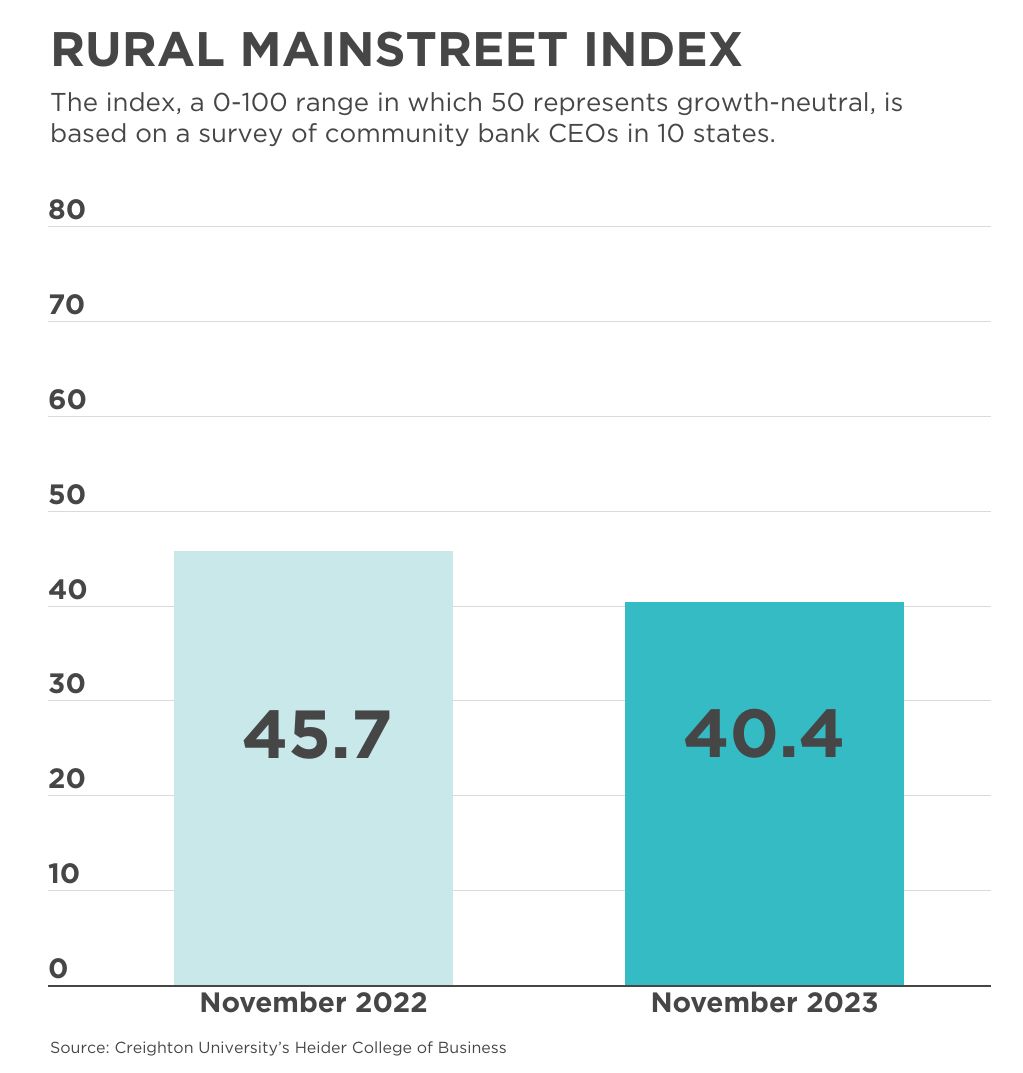

Bankers’ real-time assessment of the economy, reflected in the survey’s overall index, sank to its lowest level in more than three years. It fell to 40.4 in November from 44.4 last month and 49.5 in September. It’s the lowest since 37.9 in June 2020 “and points to weaker farm and non-farm economies,” Goss said.

This month’s survey also indicated higher mortgage rates are cutting into rural home sales, Goss said. The home-sales index dropped to 32.0 from 40.4 in October.

Higher consumer debt and elevated interest rates cut into retail sales this month, with a 44.2 retail-sales index in November’s survey compared to 46.3 in October.

Nearly 90% of bank CEOs reported this month that their areas have more job openings than workers available to fill them. This caused the hiring index to slip to 49.1 from October’s 49.2.

The farmland price index rose to 66.7 from October’s 55.6. The survey “continues to point to solid, but slowing, growth in farmland prices as farm commodity prices weakened,” said Goss.