[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Rural bank CEOs painted a less-than-rosy picture of the economy over the next six months in the latest edition of the

Rural Mainstreet Index.

Half of the respondents said they expect worsening economic conditions, citing a downturn in farm income and rising interest rates as the biggest challenges to banking profitability.

This month’s confidence index, which gauges bankers’ longer-term economic outlook, fell to 26.8, its lowest reading since July 2022 and a significant decline from 38.9 in August. In the survey of rural bankers in 10 states, the index ranges from 0 to 100 with a reading of 50.0 representing growth-neutral.

“Higher interest rates, deposit outflows and a rising regulatory environment continued to constrain the business confidence index,” said study author Ernie Goss, a business professor at Creighton University in Omaha, Nebraska.

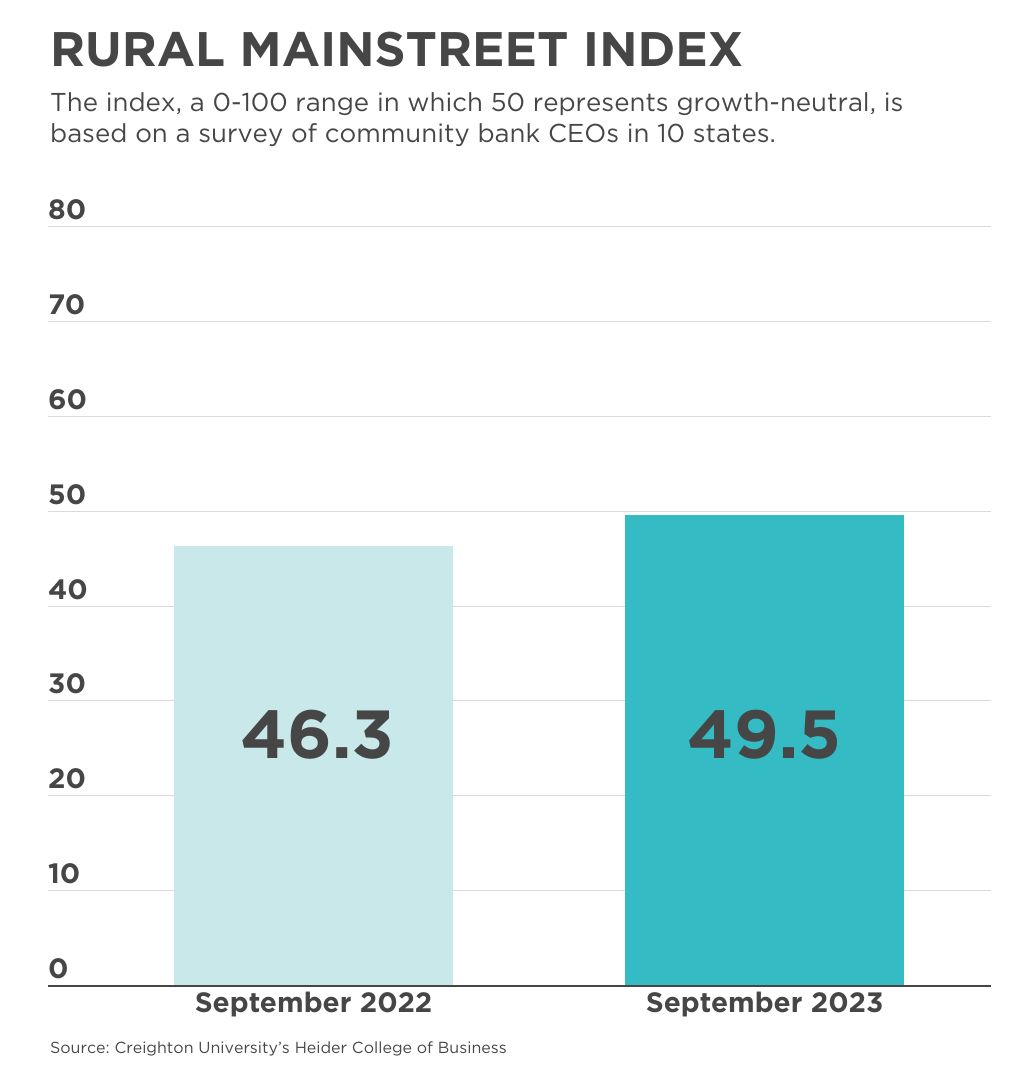

Bankers’ real-time assessment of the economy dipped to 49.5 in September from 50.0 in August—which marked its lowest point since March and the first time it was below growth-neutral this year.

Survey respondents said they are expecting a repeat of this year’s earlier bank failure crisis.

“When I say the banking crisis isn’t over, I am referring to the increased scrutiny from examiners regarding liquidity,” said James Brown, CEO of Hardin County Savings in Eldora, Iowa. “They will be very tough on that issue and that will cause some problems internally with banks of all sizes.”

Home and retail sales saw lower readings as well. The September home-sales index sank to 37.0 from August’s 59.3 amid high mortgage rates. High consumer debt and rising interest rates led to a retail-sales index of 48.1 this month, compared to 51.9 in August.

Farming-related readings were a mixed bag in September. The region’s farming and ranching land prices climbed to 65.4 from 60.0 in August, but the farm equipment-sales index fell to 44.0 from August’s 46.0. Goss said higher borrowing costs are hurting that index, which has been below growth-neutral five times during the past 12 months.