As post-pandemic job turnover in the energy sector remains high, utilities are struggling to find talent to fill increasingly technical and specialized jobs amid a transforming energy landscape, according to a new analysis of employment trends in the industry.

Turnover is at its highest point in the 17-year history of the

Energy Workforce Survey, a biennial poll by the Center for Energy Workforce Development of 41 utility companies representing around 315,000 jobs.

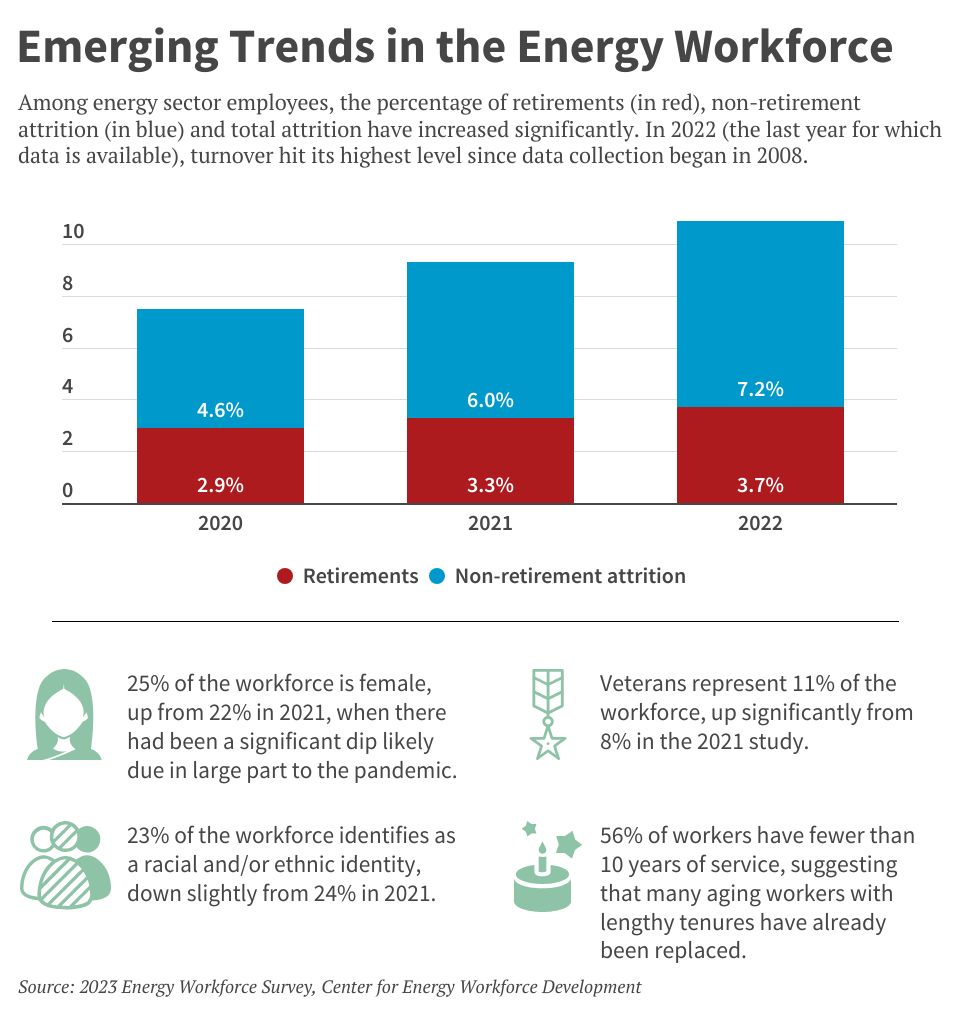

In 2022, the latest year for which CEWD data was available, more than 7% of energy sector employees left their jobs for reasons other than retirement, up from more than 6% in 2021. Retirement rates stabilized in 2021 and 2022, according to CEWD data, though electric cooperative retirements were forecast to outpace the field in 2023.

While it’s too early to determine whether high turnover will continue, the latest findings underscore an ongoing “skills and people shortage” at critical jobs, said CEWD Executive Director Missy Henriksen.

[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

“These challenges go hand-in-hand, particularly as we start trying to look ahead at how we’re going to find workers based on the way the energy industry is evolving,” she said.

Dramatically higher numbers of “emerging technology” jobs reflect that skills gap. In 2022, these jobs jumped to 2.6% of the total energy workforce from 0.6% in 2021. New energy jobs include data scientists and technicians and engineers specializing in electric vehicles, renewable energy and battery storage.

Data submitted by NRECA showed non-retirement turnover rose 20% at co-ops, with 7,911 employees leaving in 2022 compared to 6,570 in 2021. Co-ops saw slightly higher non-retirement turnover compared to their industry counterparts: 9% vs. 7%.

“A lot of people coming out of COVID started to move around for new opportunities and to seek different experiences,” said Desiree Dunham, NRECA’s workforce programs manager.

The report also shows an energy workforce that’s trending younger, a sign that utilities’ career awareness efforts appear to be paying off, Henriksen said. At 38%, millennials hold the largest share of jobs, and Gen Z hires rose sharply from 1.5% in 2021 to 9% in 2022. Co-ops in particular have a Gen Z-heavy workforce: Nearly 25% of all co-op employees were under the age of 32 in 2022.

But younger employees have implications for workforce planning given that they have less experience, the report said. More than 55% of employees have fewer than 10 years of service, and that share rises to 60% for engineers and lineworkers.

As the energy workforce continues to evolve, “training is becoming a vital tool for utilities to fill gaps in skills,” the report said. Utilities will need to step up recruiting efforts, offer programs to train and mentor existing employees and consider flexible workplace options.

Co-ops are intensifying training efforts, Dunham said, with more programs focusing on leadership development and career growth.

This year,

FreeState Electric Cooperative in Kansas, where at least 40% of employees have retired since 2017, will launch an extensive leadership program that aligns with an ongoing development program to cope with upcoming leadership transitions. Over the next decade, another 15% will be eligible to retire from the McLouth/Topeka-based co-op.

Created by Chief People Officer Desiree LaForge, the program aims to promote capable workers from within the organization through job shadowing, leadership training and other knowledge-transfer activities.

“Investing in our team’s growth is like laying the foundation for a successful cooperative future,” LaForge said.

Other key findings from the CEWD survey:

- Women hold about a quarter of energy sector jobs and slightly more at co-ops. After dipping to 22% in 2021—likely due to the pandemic—the share of women in energy sector jobs bounced back to 25% in 2022. Women composed 28% of the co-op workforce in 2022.

- The share of minority groups in the energy workforce has trended slightly downward. Twenty-three percent of the workforce “identifies as a racial and/or ethnic identity, down slightly from 24% in 2021,” the report said.

- Energy employers are hiring more military veterans than other sectors. In 2022, veterans represented 11% of utility workers compared to 8% in the previous survey—and 5.5% among all businesses, Henriksen said.

The CEWD survey consists of data for five technical job categories submitted by utility members in several areas: demographic composition, retirement forecasts and attrition data. The 140 CEWD members, which include NRECA, analyze and use the data to support strategic workforce planning.