[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

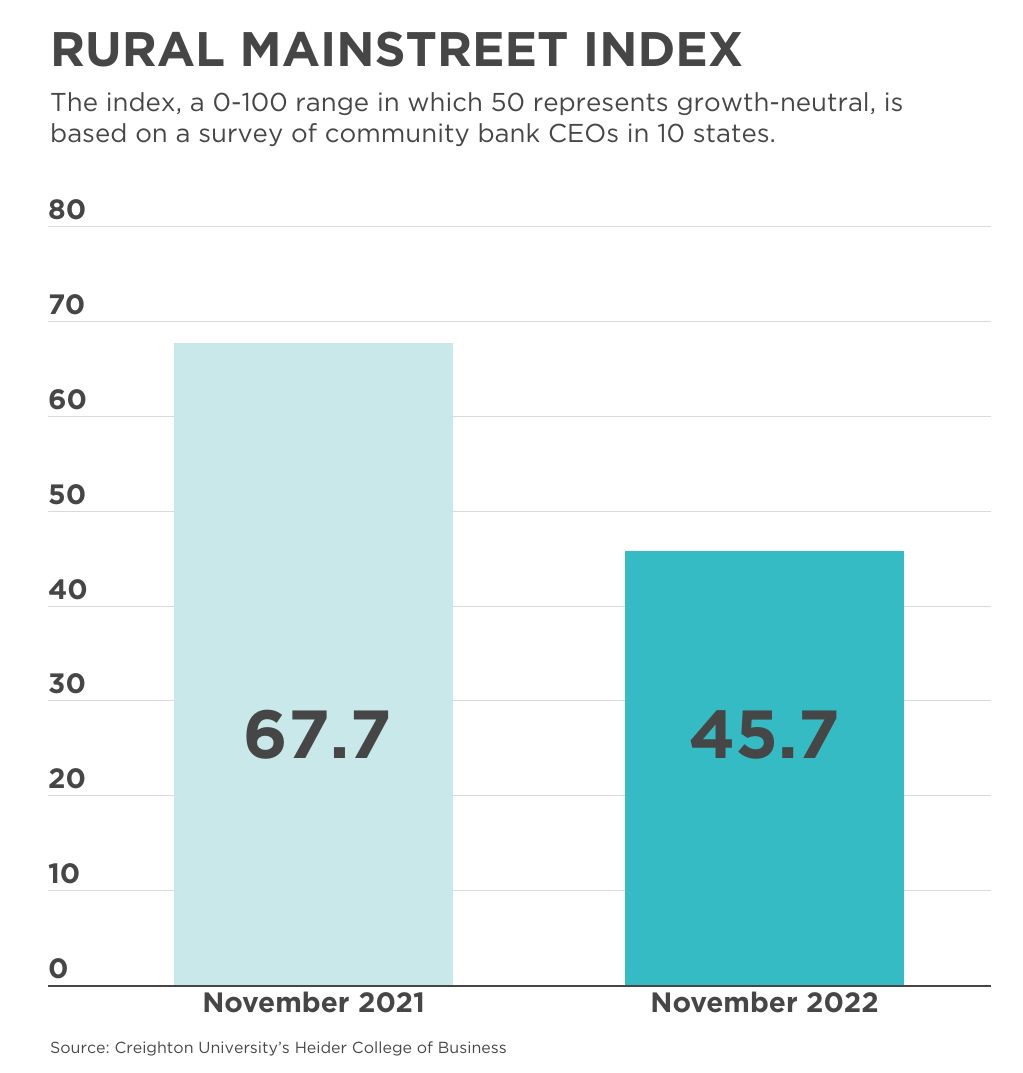

It’s now been a half year of decline in the rural economy and improvement is not coming anytime soon, according to a November survey of bankers.

This month’s Rural Mainstreet Index, bankers’ real-time assessment of the rural economy, crept upward to 45.7 from 44.2 in October, but it was still below growth-neutral.

In the monthly survey of community bank presidents and CEOs in 10 states, the index ranges between 0 and 100 with a reading of 50.0 representing growth neutral.

Recession forecasts by bankers held steady from last month, when almost one in four bankers said the downturn is already here and the rest expected it in 2023.

The confidence index, which reflects bank CEO expectations for the economy six months out, plummeted to 27.3 this month from October’s 30.8—its lowest point since the May 2020 reading of 22.1. Bankers continued to blame the slowing economy, strong energy prices, higher borrowing costs and higher costs for farming supplies for the lower outlook.

This month, bankers were asked whether farmland prices were headed up or down over the next year. Nearly 61% expect those prices to plateau at their current level, while nearly 22% expect declines. The remainder expect prices to expand, but at a slower pace.

The farmland price index rose to 68.2 in November from 58.0 in October, notching its 26th straight month of above-growth-neutral readings.

Bankers were also asked if they were requiring farmers “greater upfront financial commitments” from farmers for loans. Nearly 14% said yes, with the rest reporting no change.

Higher rates for 30-year mortgages are also cooling the housing market in rural America. This month, the home-sales index fell to 34.8 from October’s 36.0, the sixth consecutive month of decline.

“A doubling of the 30-year mortgage rate over the past year slowed home sales in the region over that time period,” said Ernie Goss, Creighton University business school professor and the study’s author.