[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

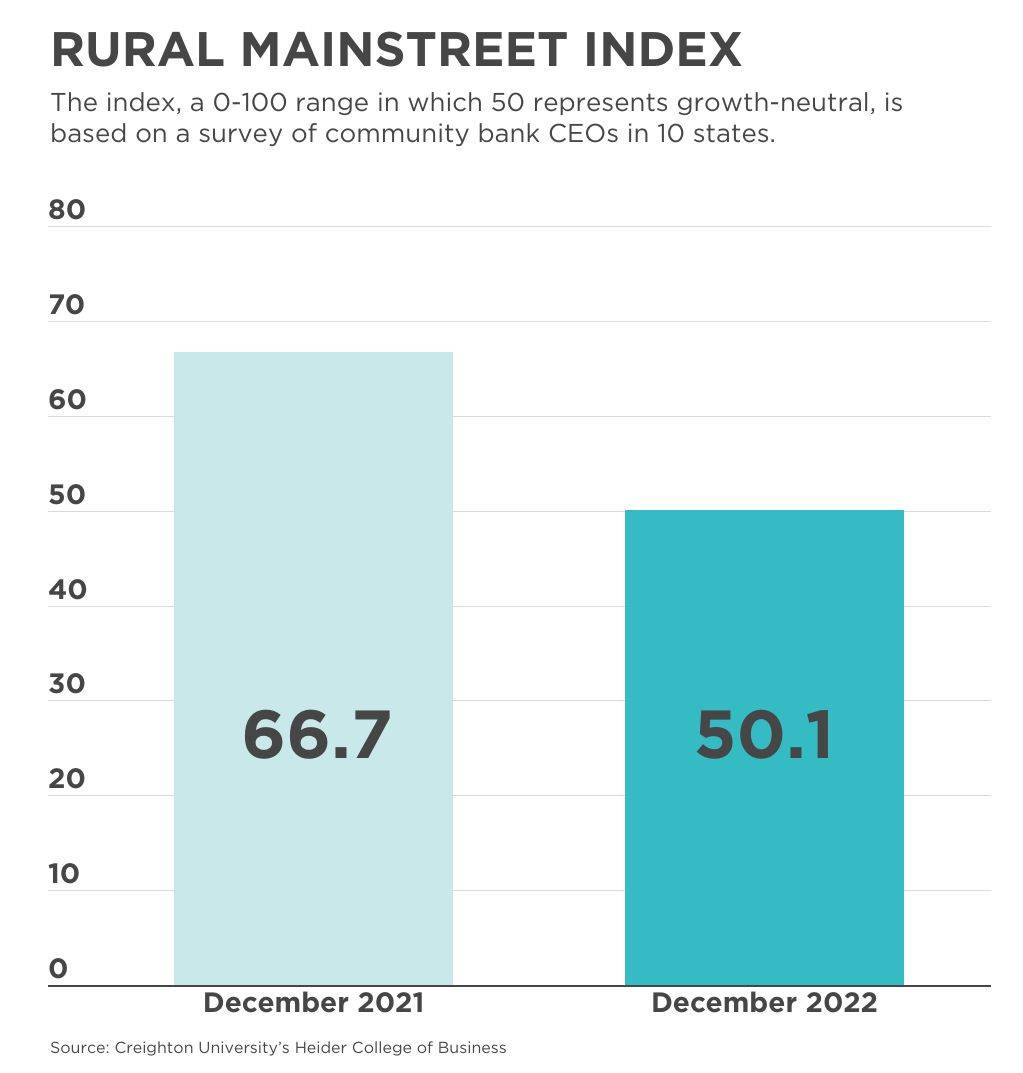

After six straight months of bleak reports from rural bankers, their monthly gauge of the rural economy is back in positive territory—but just barely.

The final

Rural Mainstreet Index of the year inched above the growth-neutral threshold to 50.1 from last month’s 45.7. The index, which reflects bankers’ real-time economic assessment, began falling in June and hit its 2022 low point of 44.2 in October.

In the monthly survey of rural bankers in 10 states, the index ranges from 0 to 100 with a reading of 50.0 representing growth neutral.

Bankers’ longer-term outlook is still firmly in negative territory due to rising interest rates and higher prices for energy and farm supplies. The confidence index, which reflects expectations for the economy six months out, was 29.6 this month, up slightly from 27.3 in November.

“Over the past nine months, the regional confidence index has fallen to levels indicating a very negative outlook,” said Ernie Goss, Creighton University business school professor and the study’s author.

The home-sales and retail-sales index are also ending 2022 below growth-neutral. The home-sales index continued its downward slump to 33.3 in December from November’s 34.8, due in large part to an almost doubling of the 30-year mortgage rate over the past year.

The December retail-sales index was unchanged from November’s 45.5, and it’s unlikely the holiday shopping season will turn things around as bankers expect holiday sales growth of less than 1% compared to last year, Goss said.

Also falling short were projections by bankers for regional net income among farmers compared to federal government forecasts. While the U.S. Department of Agriculture pegs growth at 13.8% this year, rural bankers are expecting only 10%.

Bankers were asked in the December survey whether higher interest rates are negatively affecting farmers’ purchases of agriculture equipment. More than one-third of them reported no impact, mostly because farmers are paying for purchases with cash, but 19% said higher interest rates are discouraging purchases.