[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

The drought in parts of the West and Midwest is weighing on the minds of rural bankers, as nearly half reported “damaging drought conditions” in a July survey on the rural economy.

Overall, the

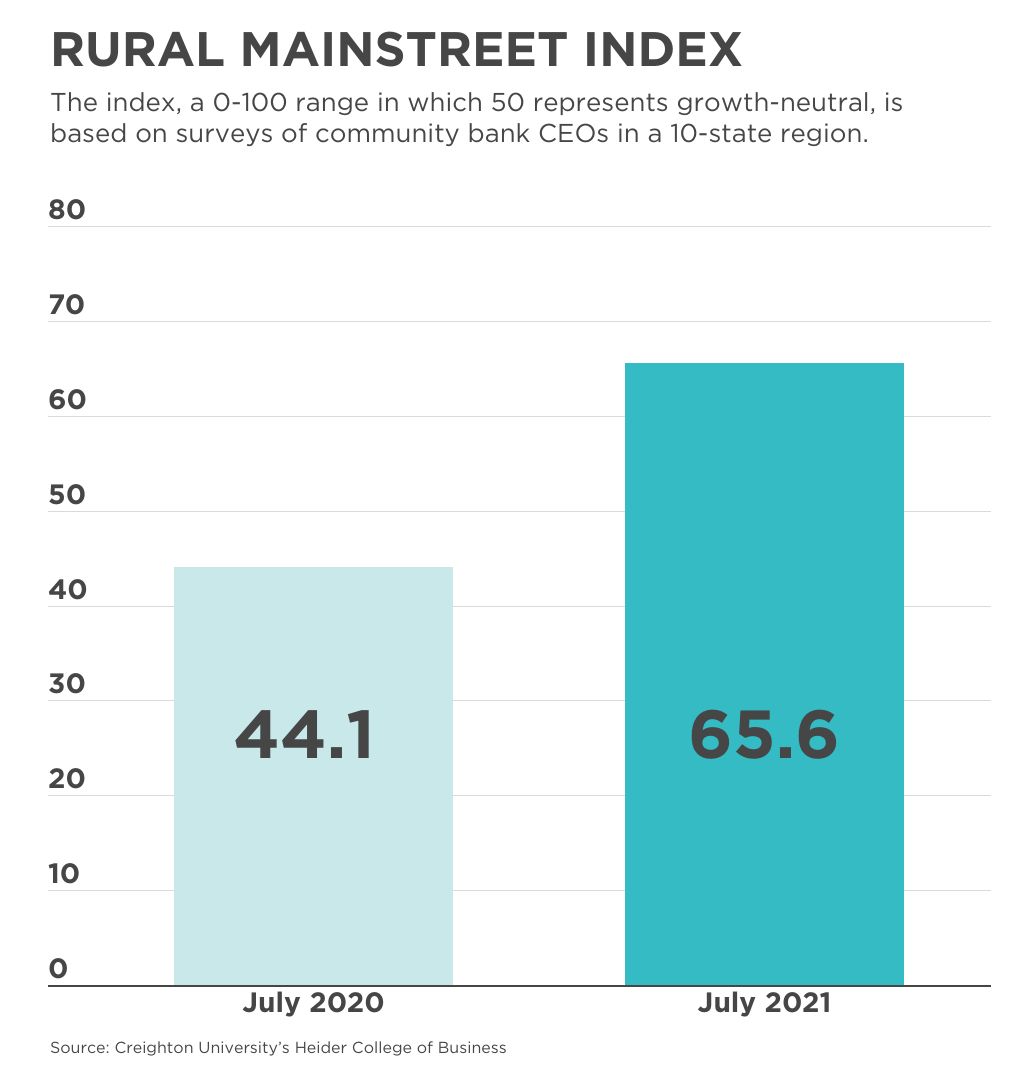

Rural Mainstreet Index, a real-time assessment of the rural economy, remains in solid growth territory despite slipping for the second straight month. July’s index fell to 65.6 from 70.0 in June and a record high of 78.8 in May, but it’s the eighth straight month the index has remained above the growth-neutral mark.

In the monthly survey of community bank presidents and CEOs in 10 states, the index ranges from 0 to 100, with a reading of 50.0 representing growth neutral.

Approximately 47% of bankers reported damaging drought conditions for farmers in their area. However, the severity of the damage varied.

“Although still under drought conditions, central Iowa has received some timely, much needed rain,” said Steve Simon, CEO of South Story Bank and Trust in Huxley, Iowa.

For the 10th consecutive month, the farmland price index was significantly above growth neutral. July’s 71.0 was down slightly from June’s 75.9.

Bankers were asked this month to estimate price growth for farmland during the previous 12 months and for the next 12 months. They projected a 5.8% increase in farmland prices for the previous 12 months but only 2.4% for the next year.

This month’s farming and ranching index shows strong growth, with nearly one-third of bank CEOs reporting that their local economy expanded between June and July. And in Minnesota, Nebraska and South Dakota, bankers reported that current nonfarm employment has exceeded pre-pandemic levels.

“Solid, but somewhat weaker, grain prices, along with the Federal Reserve’s record-low interest rates, and growing exports have underpinned the Rural Mainstreet Economy. Even so, current rural employment remains below pre-pandemic levels,” said Ernie Goss, a professor at Creighton University’s College of Business in Omaha, Nebraska, which produces the index.

The confidence index, which reflects bank CEO expectations for the economy six months out, is still above growth-neutral territory this month, although it slipped to 65.6 from June’s 71.7.

“Federal stimulus checks, healthy grain prices, and advancing exports have supported strong confidence numbers over the last several months,” said Goss.