[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

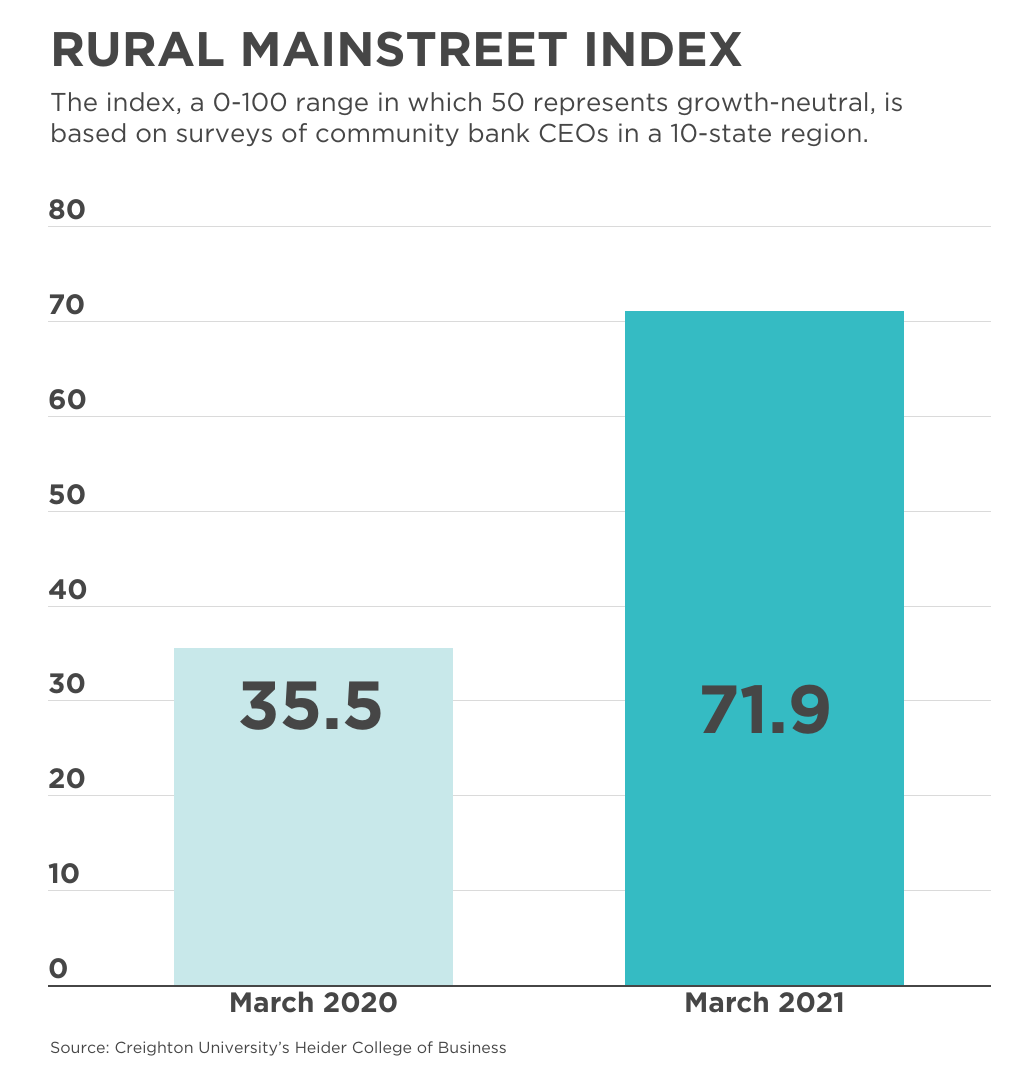

A barometer of the rural economy in Plains and Western states has soared to its highest level since the survey of bankers began in 2006.

March’s Rural Mainstreet Index shot up more than 18 points to 71.9 from February’s 53.8. It’s the fifth time in the last six months that the index has been above growth neutral. Nearly 70% of bank CEOs responding to the survey reported an expanding local economy, while the remainder indicated little or no growth.

The Rural Mainstreet Index surveys community bank presidents and CEOs in 10 states.

The index ranges between 0 and 100, with 50.0 representing growth neutral.

“Sharp gains in grain prices, federal farm support, and the Federal Reserve’s record-low interest rates have underpinned the rural Main Street economy,” said Ernie Goss, economics professor at Creighton University’s Heider College of Business, which produces the index. “Only 3.1% of bank CEOs indicated economic conditions worsened from the previous month.”

Goss also cautioned that despite this month’s gains, “current rural economic activity remains below pre-pandemic levels.”

The survey’s confidence index, which reflects bank CEO expectations for the economy six months out, rose to 76.7 from February’s 64.0.

“Looming federal farm support payments, improving grain prices, and advancing exports have supported confidence offsetting negatives from pandemic-ravaged retail and leisure and hospitality companies in the rural economy,” said Goss.

Two other indicators in the monthly survey also hit record levels. The farmland price index climbed to 71.9, its highest level since November 2012 and up from February’s 60.0. And the March farm equipment-sales index rose to 63.5, its highest reading since February 2013 and up from 62.7 last month.

Goss noted that “after 86 straight months of readings below growth neutral, farm equipment bounced into growth territory for the last four months.”