[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

The latest monthly survey of rural bankers suggests the economy is slowly improving in rural parts of 10 Plains and Western states, but employment remains below pre-pandemic levels.

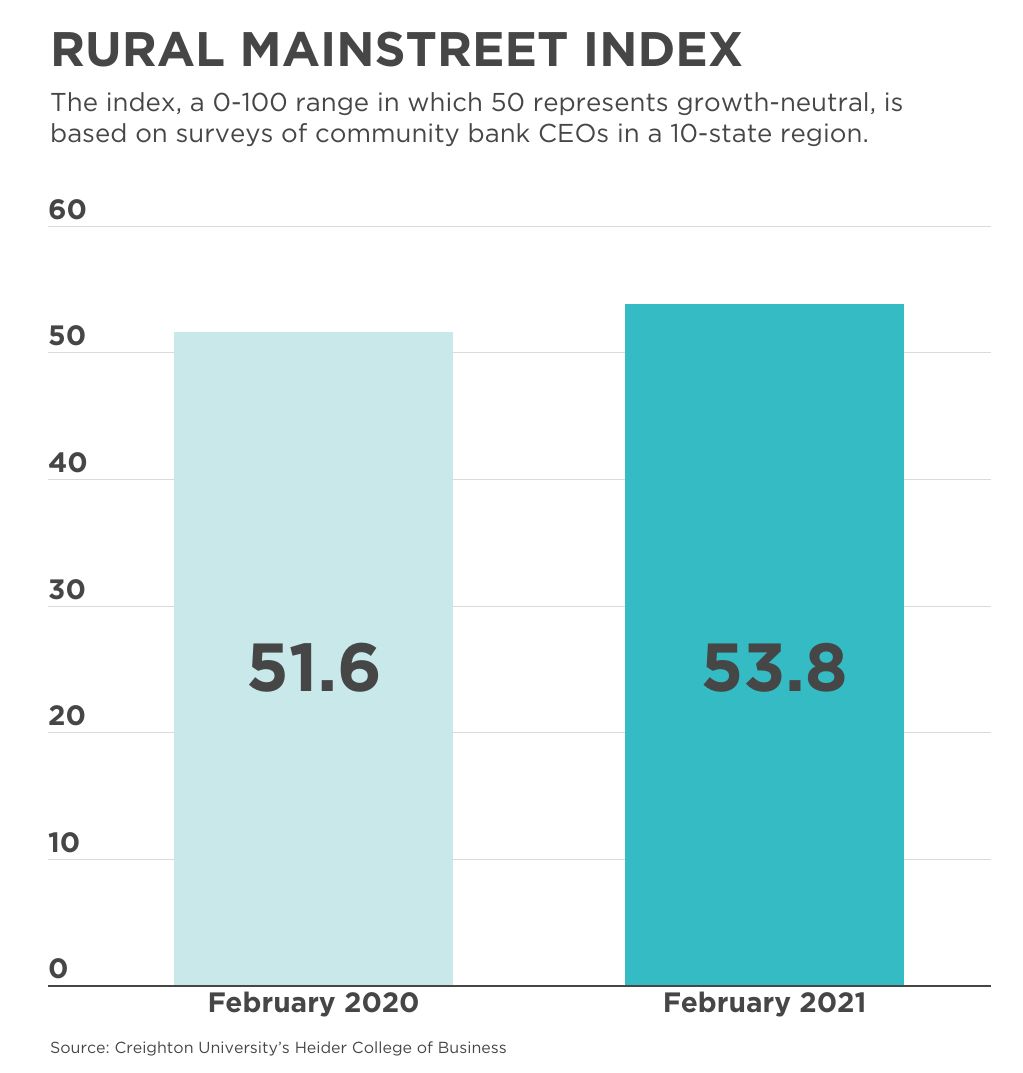

The Rural Mainstreet Index—a real-time analysis of the rural economy—rose to 53.8 in February from January’s 52.0. It’s the highest reading since January 2020.

Any score below 50 suggests a shrinking economy, while a score above 50 suggests a growing economy.

“Sharp gains in grain prices, federal farm support, and the Federal Reserve’s record-low interest rates” contributed to the improved assessment, said Ernie Goss, a professor at Creighton University’s Heider College of Business, which produces the Rural Mainstreet Index.

And while only 8% of bank CEOs indicated that economic conditions have worsened from the previous month, “current rural economic activity remains below pre-pandemic levels,” said Goss.

The best news in this month’s survey is the confidence index, which reflects bank CEO expectations for the economy six months out. That index notched its highest reading since March 2011 at 64.0 in February compared to January’s 60.0.

“Federal farm support payments, improving grain prices and advancing exports have supported confidence offsetting negatives from pandemic-ravaged retail and leisure and hospitality companies in rural areas,” said Goss.

The new hiring index climbed to 51.9 from January’s 46.0. But nonfarm employment levels are down by 236,000, or 5.3%, compared to the year before, according to data from the Department of Labor’s Bureau of Labor Statistics.

“It will take many months of above growth neutral readings to get back to pre-COVID-19 employment levels for the region,” said Goss.

The home-sales index climbed to 69.2 in February, up from 60.0 in January. The retail-sales index bumped up to 46.2 this month, compared to 42.0 in January.

“On-line buying and business closures linked to COVID-19 continue to harm the region’s retailers,” said Goss.