[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

The ongoing drought, inflation and labor shortages continue to weaken the rural economy, according to a monthly survey of bankers.

The

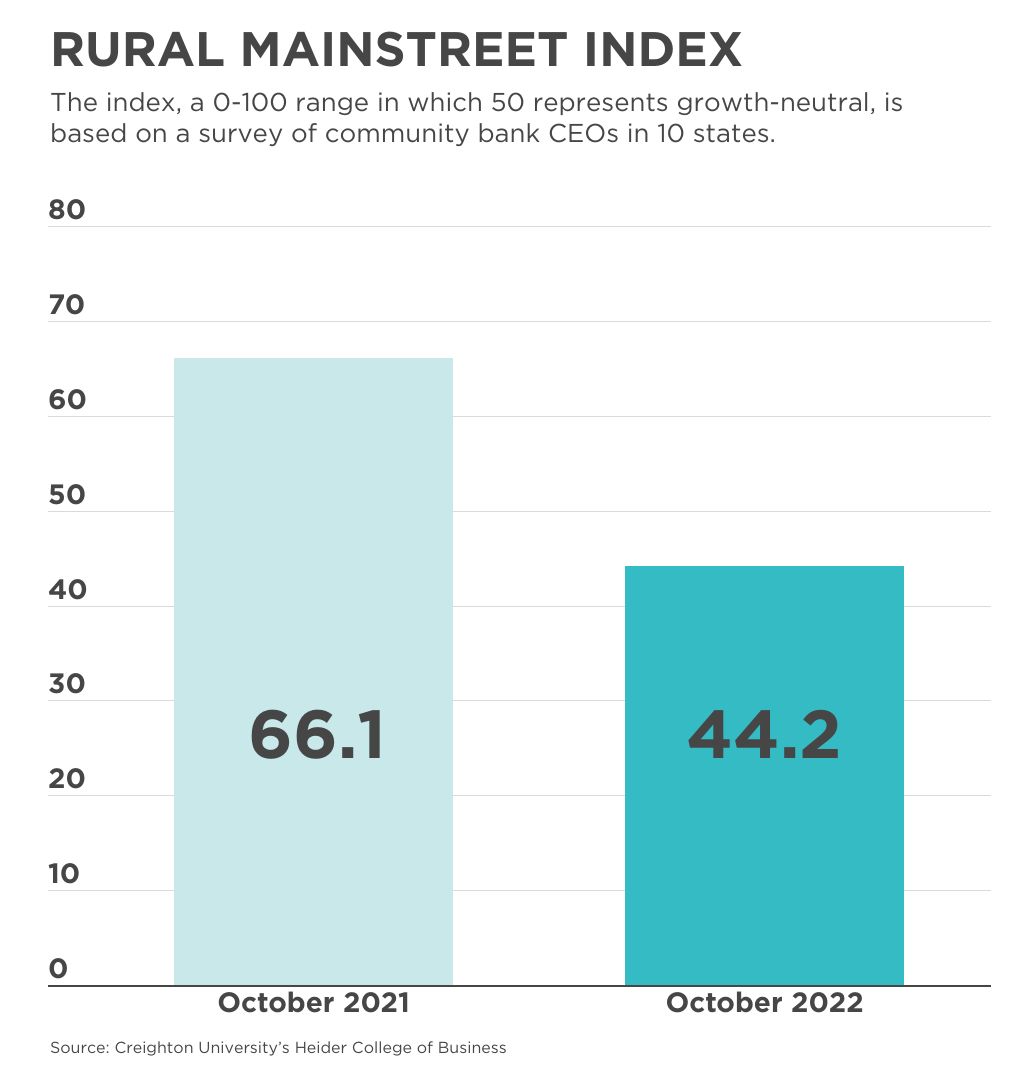

Rural Mainstreet Index, which gauges bankers’ real-time assessment of the economy, inched up to 46.3 from 44.0 in August, but it still marked the fourth consecutive month of a below-growth-neutral reading.

In the survey of community bank presidents and CEOs in 10 states, the index ranges from 0 to 100, with a reading of 50.0 representing growth neutral.

“The Rural Mainstreet economy is now experiencing a downturn in economic activity,” said Creighton University business school professor Ernie Goss, the study’s author. “Supply chain disruptions and inflationary pressures from higher farm input costs continue to constrain growth.”

This month, bankers weighed in on the greatest economic pressures over the next year. Four in 10 cited “high and escalating farm input costs,” such as equipment and fertilizer, and 21% said the drought was the biggest economic challenge going forward.

“Farmers and bankers are bracing for escalating interest rates, higher farm input costs, and drought,” Goss said.

September survey results didn’t bring much in the way of good news for new hires or home and retail sales. The new hiring index fell below the growth-neutral threshold for the first time this year—49.2, compared to last month’s 52.0. The home sales index rose a bit to 46.2 from August’s 44.0, and the retail sales index fell to 46.0 from August’s 48.0.

Earlier this year, April was a high-water mark for two of those readings—70.0 for the home sales index and 64.0 for the new hiring index.

The survey’s confidence index, which gauges bankers’ six-month outlook for the economy, crept up to 40.7 this month from August’s 38.0—but it was still well below growth neutral.