[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Low loan volume, inflation and higher long-term interest rates are the rural bankers’ top concerns for 2021, according to a monthly survey of rural bankers.

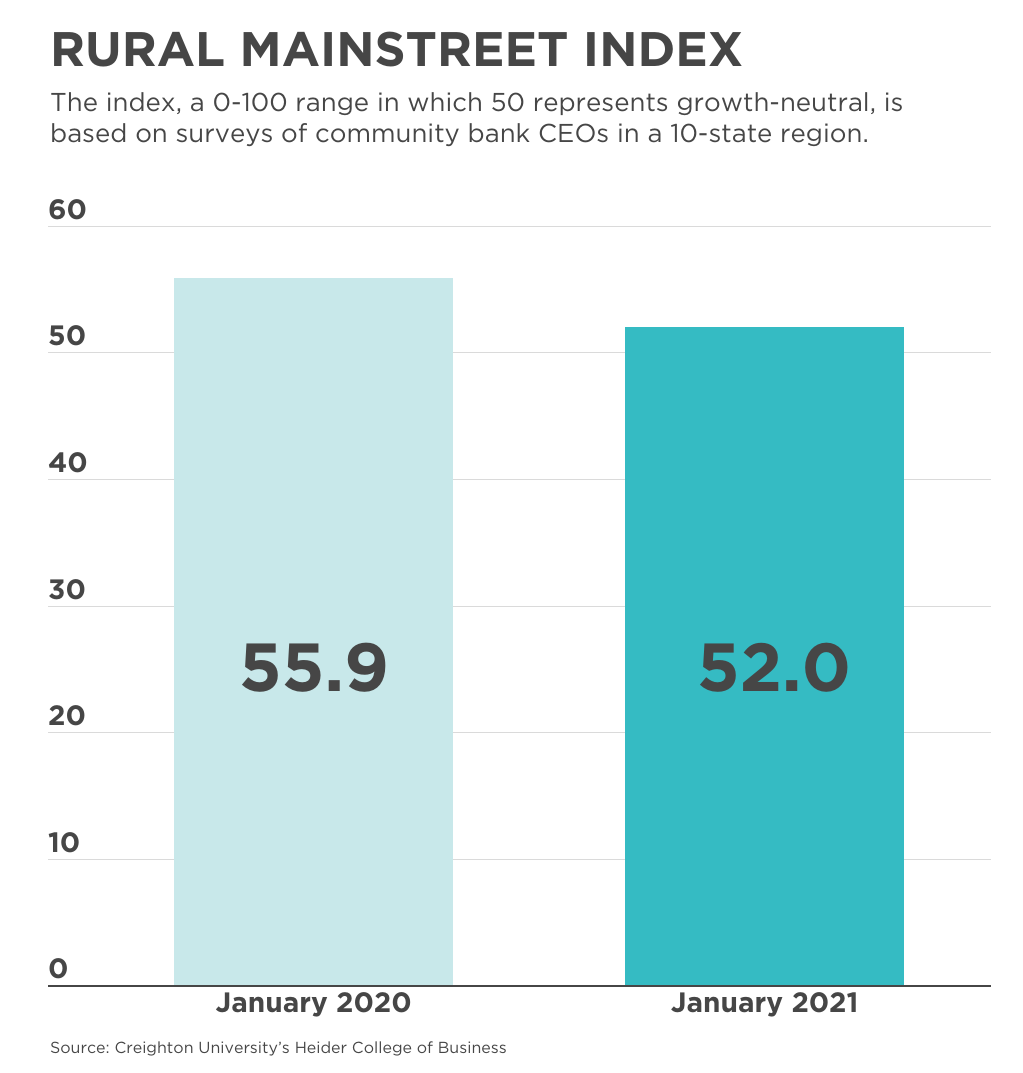

The survey's overall index— a real-time analysis of the rural economy—inched up to 52.0 in January from December’s 51.6. It’s the third time in the last four months the index has climbed above growth neutral and the second-highest reading since January 2020.

Any score below 50 suggests a shrinking economy, while a score above 50 suggests a growing economy.

“Recent sharp improvements in agriculture commodity prices, federal farm support payments, and Federal Reserve’s record low short-term interest rates have underpinned the Rural Mainstreet Economy in a solid and positive growth range,” said Ernie Goss, a professor at Creighton University’s Heider College of Business, which produces the

Rural Mainstreet Index.

Goss cautioned, however, that “the rural economy remains well below pre-pandemic levels.”

Loan volumes will still be low, and in this month’s survey, 44% of bankers said that’s the biggest concern for their banks for 2021. At this time last year, just 7% were concerned about loan volume, and loan defaults and bankruptcies topped their list of concerns for their bank economy. Bankers’ top overall economic concerns for 2021 are excessive inflation and higher long-term interest rates.

“I feel the economy is moving in a positive direction that can be rattled by a combination of higher taxes, higher inflation and a return of stricter regulation,” said Jim Levick, president of Nebraska State Bank in Oshkosh and one of the participants in the survey.

Banker concern might be linked to this month’s readings for home and retail sales. The January home-sales index was still above growth-neutral at 60.0 but lower than December’s 71.0. The retail-sales index for January rose to 42.0 from 40.6 in December but was still below growth-neutral.

“Online buying and business closures linked to COVID-19 continue to harm the region’s retailers,” said Goss.

The confidence index, which reflects bank CEO expectations for the economy six months out, dropped slightly to 60.0 from December’s 62.9.

“Federal farm support payments, improving grain prices, and advancing exports have supported confidence offsetting negatives from pandemic ravaged retail, leisure and hospitality companies in rural areas,” said Goss.