[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

The rural economy is going strong, but bankers are concerned about a possible downturn in farm income and the impact of the drought gripping the West.

Overall, the

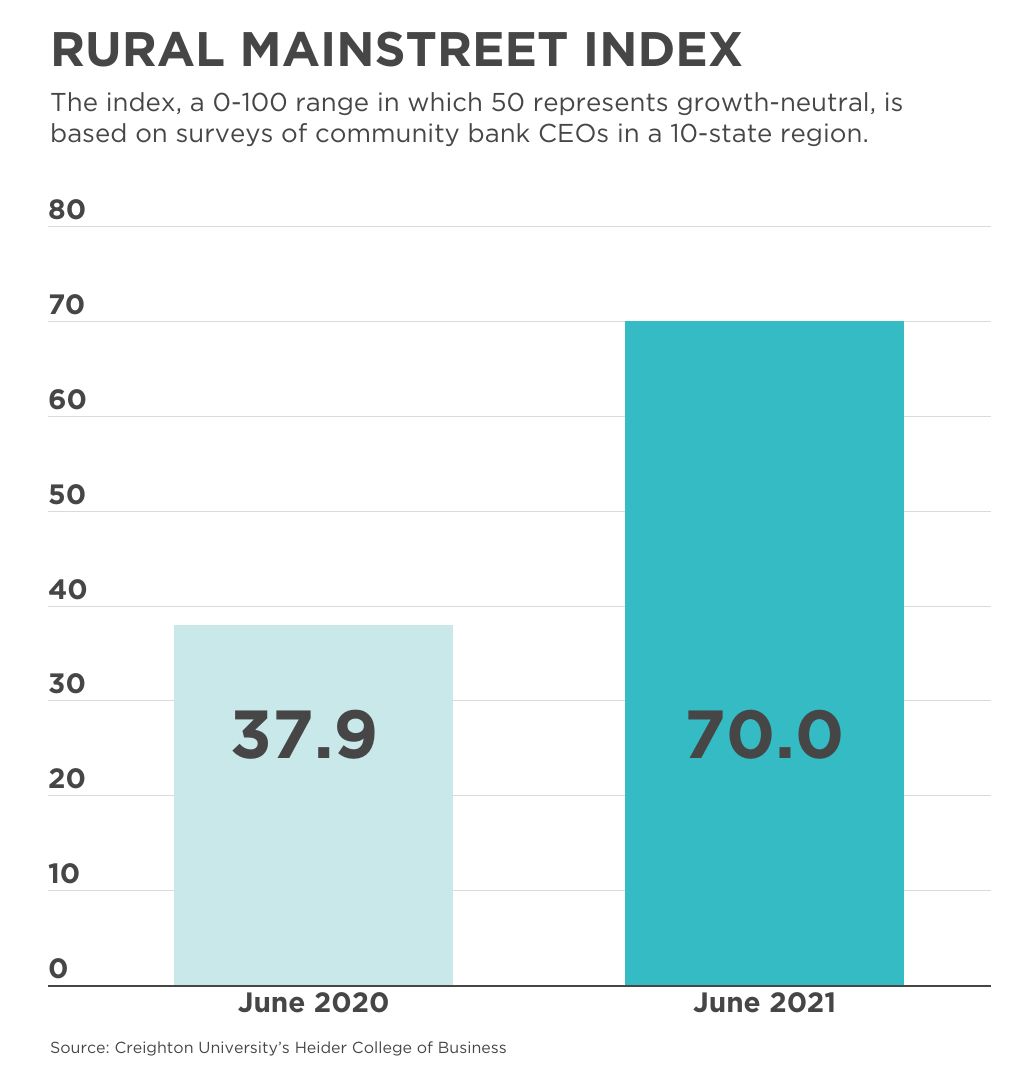

Rural Mainstreet Index remains in solid growth territory despite falling to 70.0 in June from May's record high of 78.8 on a scale of 0 to 100. It's the seventh straight month the index has remained above the growth-neutral mark of 50.

The Rural Mainstreet Index, a real-time assessment of the rural economy, is based on a survey of community bank presidents and CEOs in 10 states.

Several bankers raised concerns, including future drought impacts. “Continued dry conditions will start to have an effect on markets and crops soon," said Steve Simon, CEO of South Story Bank and Trust in Huxley, Iowa.

The survey asked bankers to name the greatest threat to 2021-22 bank operations. Approximately one-fourth identified a downturn in farm income and another quarter said more government regulations.

Respondents also weighed in about the current rise in inflation. About 30% of those surveyed expect the increase to be temporary, but more than 75% think the Federal Reserve should begin raising interest rates before the end of 2021.

The confidence index, which reflects bank CEO expectations for the economy six months out, fell to 71.7 from May's 78.8.

“Federal stimulus checks, strong grain prices, and advancing exports have supported a healthy confidence number," said Ernie Goss, a professor at Creighton University's College of Business in Omaha, Nebraska, which produces the index.

The indicators for farming and ranching recorded their best readings in about 10 years. For the ninth straight month—and the first time since 2013—the farmland price index advanced significantly above growth neutral, even though the June reading slipped to 75.9 from May's 78.1.

The June farm equipment sales index rose to 71.6 from 67.9 in May, its highest level since 2012.