[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Bankers’ confidence in the rural economy took a dive this month amid forecasts for lower corn and soybean prices and as the Federal Reserve considers interest rate hikes.

That’s according to the most recent

Rural Mainstreet Index, a monthly 10-state survey of community bank presidents and CEOs. The confidence index, which reflects bankers’ expectations for the economy six months out, sank to 51.9 from 61.1 in January. The index ranges between 0 and 100, with 50.0 representing growth-neutral.

Bankers expect the Federal Reserve to raise short-term interest rates by 1 percentage point, which is up from 0.70% last month. Should the rate hike happen, an Illinois banker recommended a go-slow approach and urged the Fed to “evaluate the impacts as they are implemented and not be saddled with a fixed plan,” according to the survey.

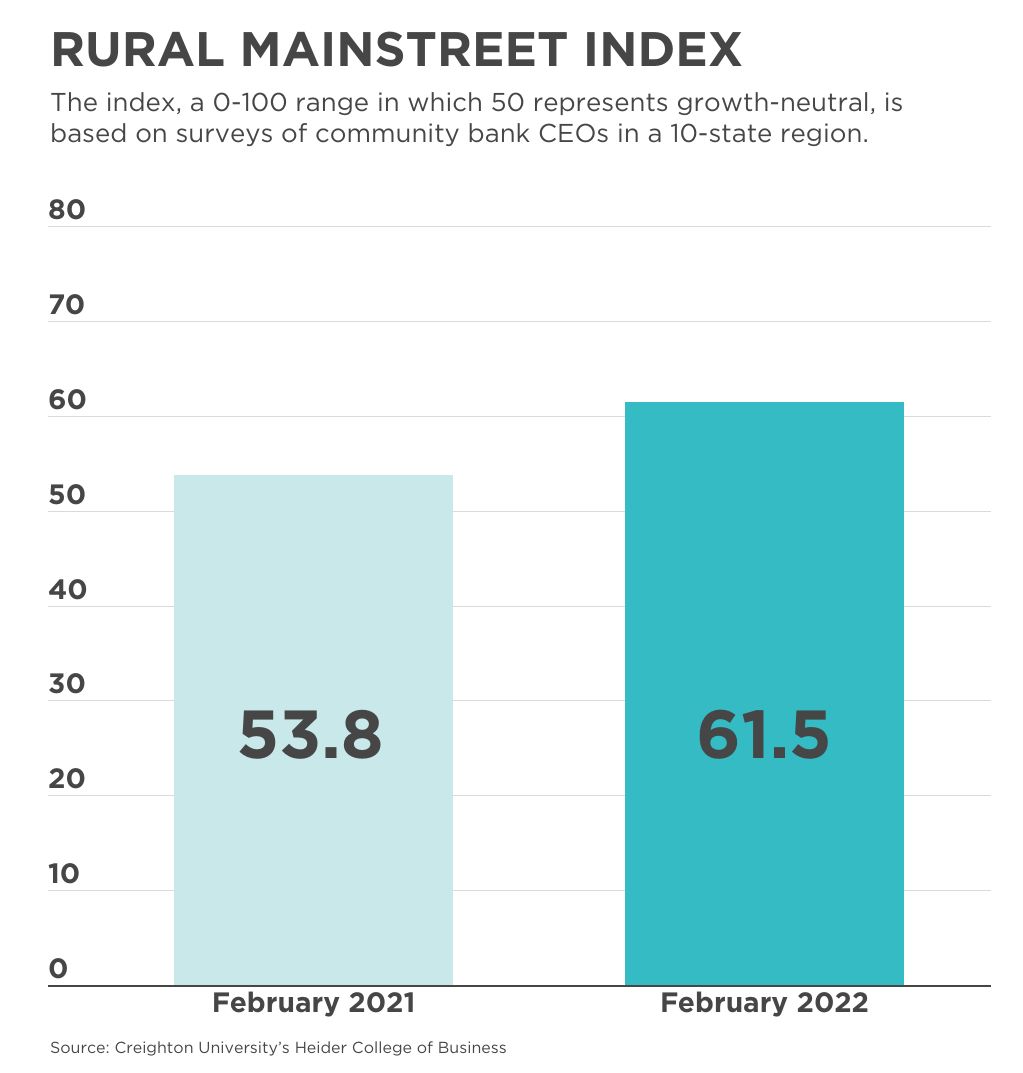

The overall index, which gauges bankers’ real-time assessment of the rural economy, inched up to 61.5 in February from January’s 61.1, “indicating healthy, consistent growth for the region,” the study said.

The home-sales index dipped to 63.5 from January’s 65.4, and the retail-sales index crept up to 57.7 from January’s 57.4.

“Healthy farm commodity prices and federal stimulus spending are having positive impacts on Rural Mainstreet retail sales and home sales,” said Ernie Goss, the study’s author and a professor at Creighton University’s business school.

The new hiring index expanded to 61.5 from 61.1 last month, capping a 12-month period showing a gain of 4.2% in nonfarm employment, according to the Bureau of Labor Statistics.

The farmland price index dipped to a still-strong 78.8 from January’s 88.5 and December’s record high of 90.0. February’s reading represented the 17th straight month the index was above growth neutral.