[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

The rural economy remains strong, but bankers are concerned about persistent inflation, according to a monthly survey.

Creighton University’s latest

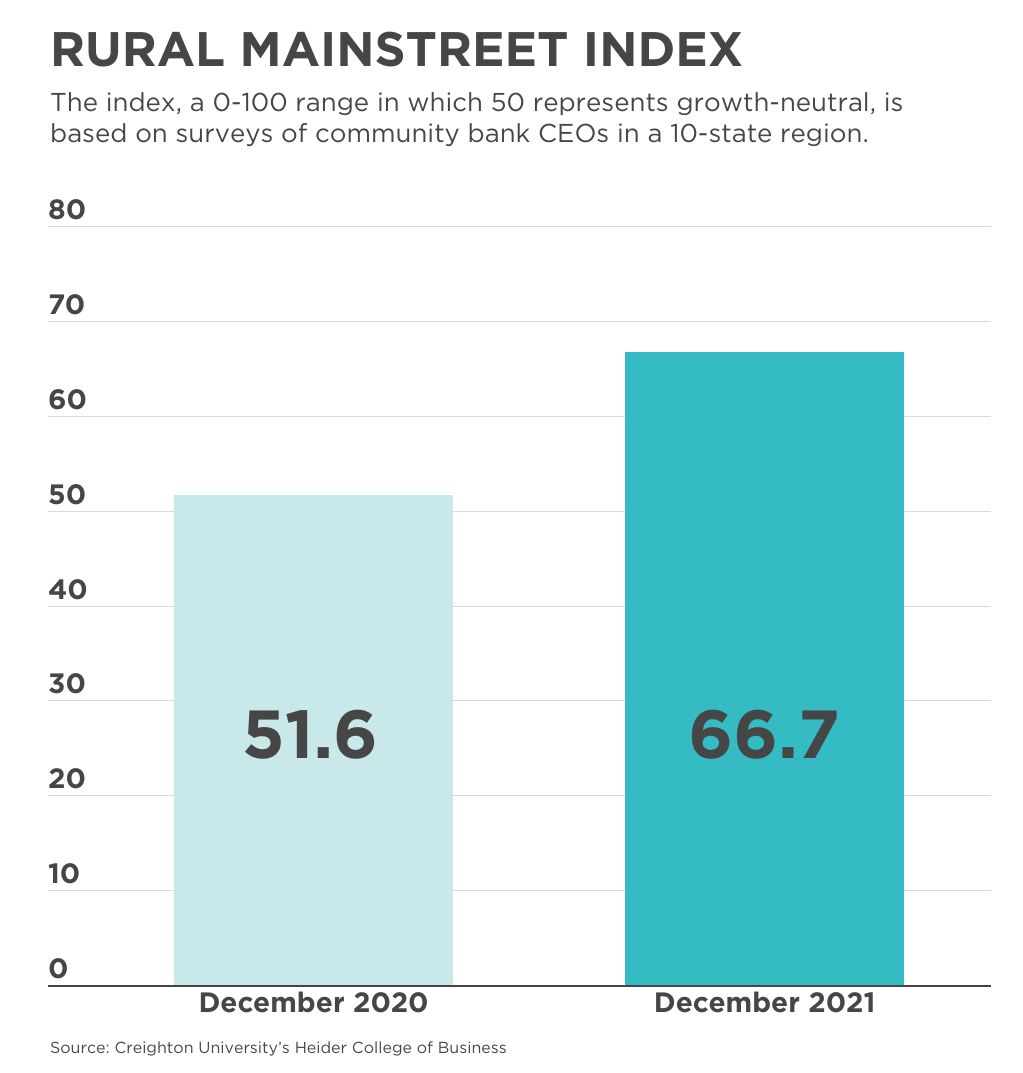

Rural Mainstreet Index took a slight dip to 66.7 from November’s 67.7. The index ranges from 0 to 100 with a reading of 50.0 representing growth neutral.

December marks the 13th straight month of an above-growth-neutral real-time assessment of the rural economy by bankers, “indicating healthy, consistent growth for the region,” said Ernie Goss, a professor at the university’s Heider College of Business, which produces the monthly survey of bank CEOs in rural parts of 10 states.

“Seven of 10 bankers described their local economy as expanding, while only 6.7% indicated that their local economy was in a modest economic downturn,” said Goss.

But persistently high land costs and soaring prices for supplies is a concern. “Inflation is real and affecting folks in our service areas,” said Jeff Bonnett, CEO of Havana State Bank in Havana, Illinois.

For example, bankers reported that annual cash rents for non-irrigated, non-pasture farmland soared to $262 from $218 in February 2020, a month before the onset of the pandemic. Meanwhile, the farmland price index rose to a record 90.0 from November’s 85.5, the previous record high. That marks the 15th consecutive month the index has been above growth neutral.

Nevertheless, the confidence index, which reflects bank CEOs’ expectations for the economy six months out, rose to 55.2 in December from 48.4 in November. Previously, that index had dropped for five straight months.

December’s home-sales index climbed to 72.4 from November’s healthy 65.0, and the retail-sales index rose to 68.3 from 58.1. “Healthy farm prices and federal stimulus spending are having very positive impacts on Rural Mainstreet retail sales and home sales,” said Goss.