[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

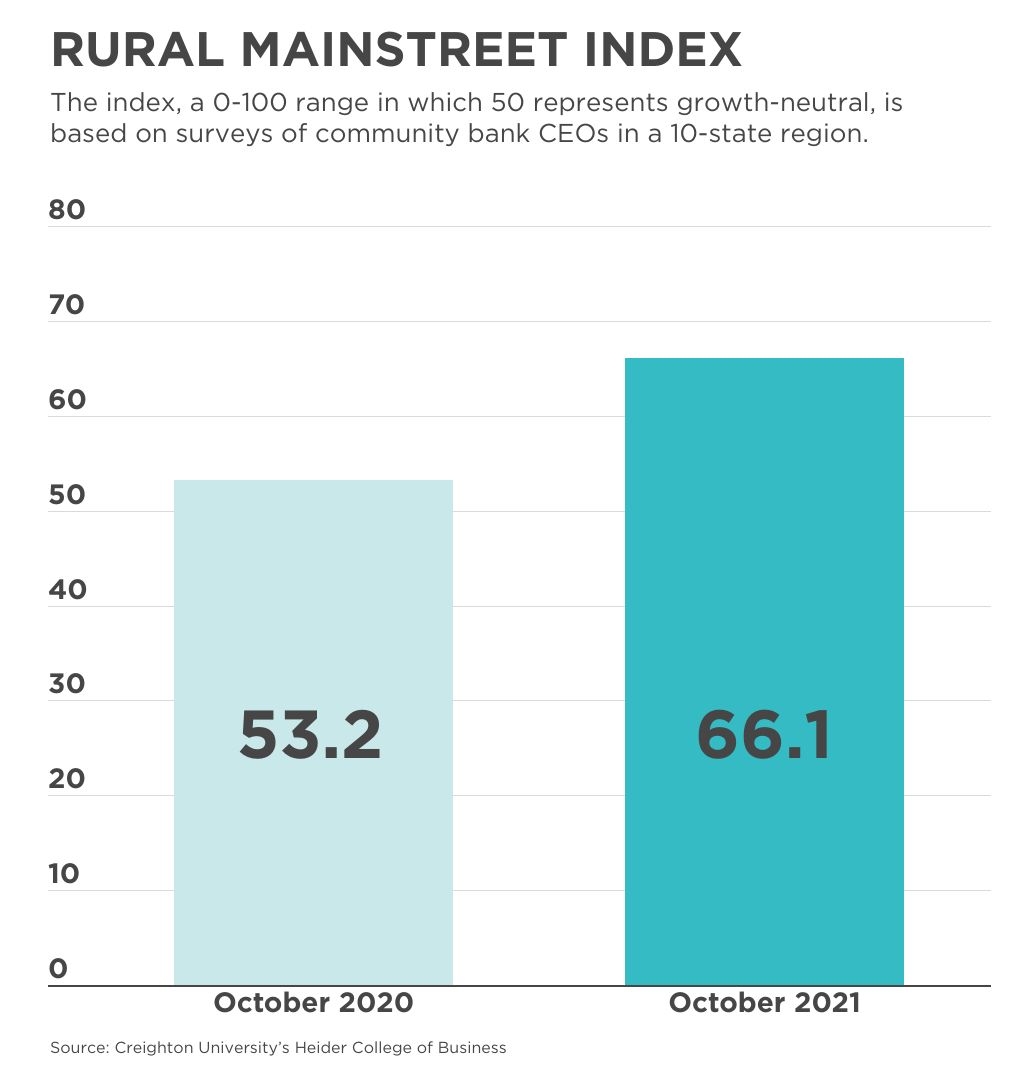

Strong farmland prices and exports are continuing to boost the rural economies in 10 Plains and Western states, according to an October survey of bankers.

The region's overall economic reading improved this month to 66.1 from September's 62.5, according to the most recent

Rural Mainstreet Index. It's the 11th consecutive month of growth.

The index ranges from 0 to 100 in the monthly survey of community bank presidents and CEOs, with a reading of 50.0 representing growth neutral.

Creighton University economist Ernie Goss, the study's author, said the region is benefiting from solid grain prices, continued record-low interest rates and growing agricultural exports.

Data from the U.S. Department of Agriculture show that “2021 year-to-date agriculture exports are more than 25.4% above that for the same period" last year, Goss noted.

Readings for two indicators, farmland prices and farmland equipment sales, remain particularly strong despite small declines. The farmland price index dipped to 81.5 from September's record high 85.2, and the farm equipment sales index fell to a still-strong 64.8 from 66.0 in September.

In addition, more than eight in 10 of bankers indicated that local farmers were in a “solid cash position," with little need for borrowing. The remaining bankers reported farmer cash positions changed little from past years.

Hiring also remained strong. The new hiring index improved to 71.4 from 67.9 in September, although labor shortages continue to be a significant issue.

This month's report contains a few troublesome areas. The confidence index, which reflects bank CEO expectations for the economy six months out, sank for the fourth straight month to 51.8, its lowest level since November of last year, and down from September's 65.4.

The current hot-button issues of supply chain disruptions and inflation could pose a threat to rural economies. Congestion at domestic transportation hubs is the biggest supply chain disruption for farmers, bankers indicated.