[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Surging prices for fertilizer and other farm supplies are the greatest economic risk in 2022 for farmers, according to a monthly survey of rural bankers.

In the latest

Rural Mainstreet Index, bankers in 10 states overwhelmingly named inflation as the biggest threat to local economies, followed by supply chain disruptions and rising interest rates.

“Inflation is a serious problem here,” said Jim Eckert, president of the Anchor State Bank in Anchor, Illinois, citing rising gasoline and food prices.

Bankers expect the Federal Reserve to raise short-term interest rates by 0.70% this year, according to the survey. And about 19% of those surveyed expect four or more one-quarter percentage point rate hikes in 2022.

Perhaps in response to interest rate fears, the January loan volume index plummeted to 28.8 in January from December's 61.7. “While January farm loans are normally low, this reading was below normal January readings,” the survey said.

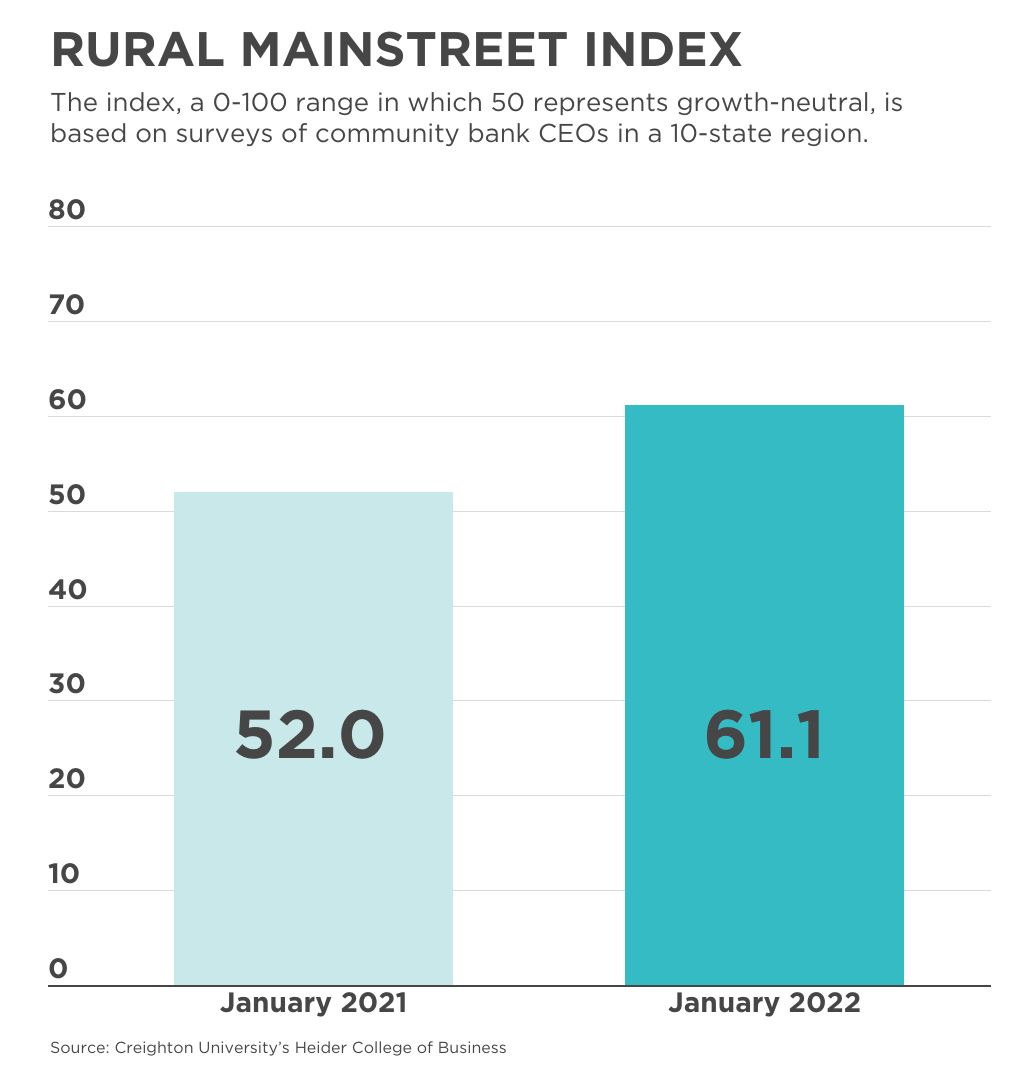

The overall index, which gauges bankers’ real-time assessment of the rural economy, fell in January to 61.1 from December's 66.7 but still remained above growth-neutral for the 14th straight month. The index ranges from 0 to 100, with 50.0 representing growth neutral.

Creighton University economist Ernie Goss, the study’s author, said this month’s reading indicates “healthy, consistent growth for the region,” which continues to benefit from solid grain prices, continued record-low interest rates and growing agricultural exports.

The continued streak of favorable farm commodity prices is keeping home and retail prices aloft, despite lower readings this month, said Goss. The home-sales index dropped to a still-strong 65.4 from December's 72.4. The retail-sales index for January fell to 57.4 from 68.3 last month.

Another bright spot this month is the ongoing string of above-growth-neutral readings for farm equipment sales, now 16 months long, and farmland prices, now at 14 months.

The farmland price index fell to 88.5 from December’s record high of 90.0, while the equipment sales index slipped to 72.4 from 74.1 in December.

The confidence index, which reflects bank CEO expectations for the economy six months out, rose for a second straight month to 61.1 from 55.2 in December.