[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Rural bankers are reporting slow economic growth in a monthly survey, and their longer-term outlook expresses doubt that things will change anytime soon.

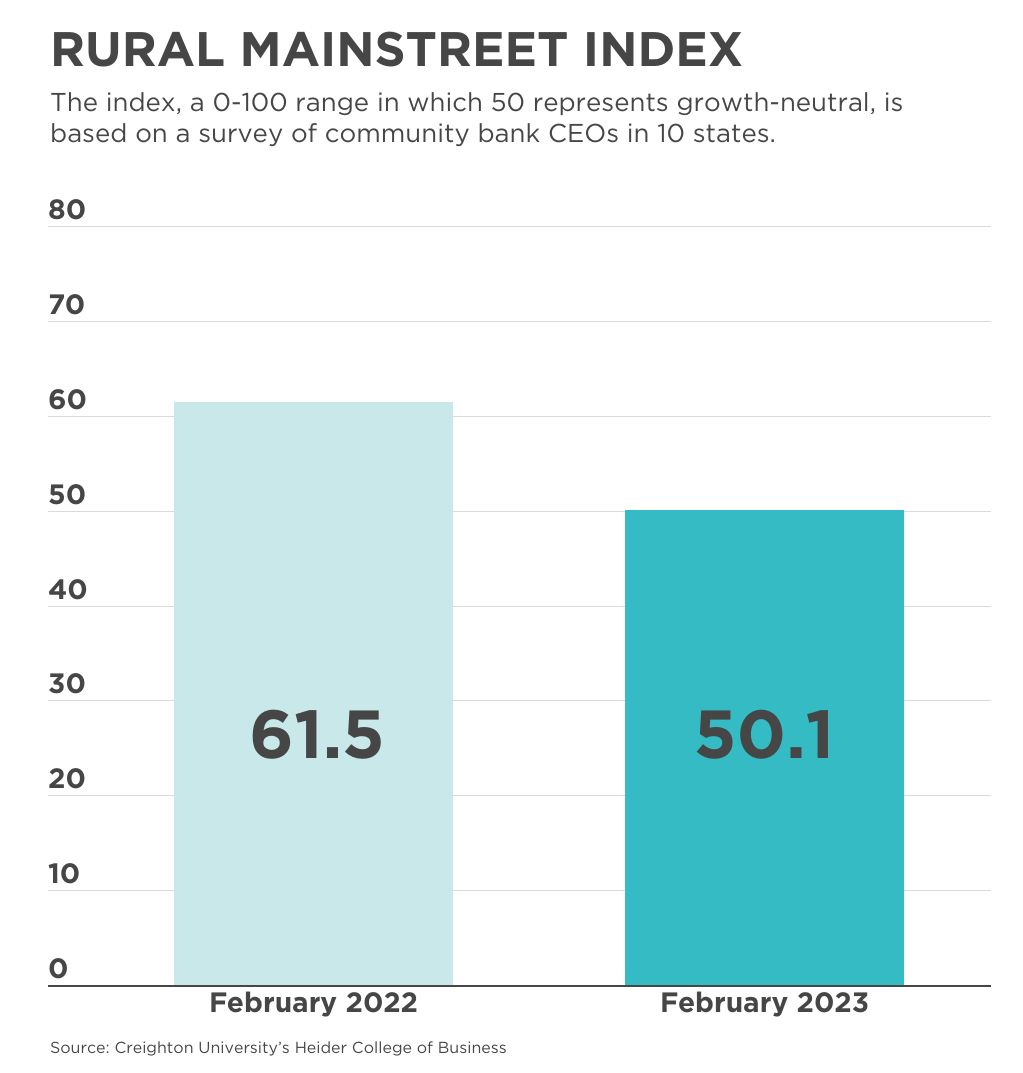

The overall reading in February’s

Rural Mainstreet Index, which gauges bankers’ real-time assessment of the economy, dipped to 50.1 from 53.8 in January. In the survey of rural bankers in 10 states, the index ranges from 0 to 100 with a reading of 50.0 representing growth-neutral.

“Only 7.4% of bankers reported improving economic conditions for the month with 85.2% indicating no change in economic conditions from January’s slow growth,” said Ernie Goss, Creighton University business school professor and the study’s author.

These conditions, along with higher borrowing costs and labor shortages, kept bankers’ longer-term outlook for the economy in negative territory. The confidence index, which reflects their economic expectations six months out, crept up to 44.4 from 40.4 in January.

“Over the past 11 months, the regional confidence index has fallen to levels indicating a very negative outlook,” Goss said.

The hiring index in the 10-state area fell to 48.1 this month, compared to January’s 53.9, an indicator that labor shortages continue to be a “significant issue constraining growth” for rural businesses.

Farmland values continue to stay strong, with February’s farmland price index at 63.5, compared to January’s 66.0—marking nearly two and a half years of that index staying above 50.0.