[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

Rural bankers are optimistic about this year’s holiday shopping season, but their longer-term economic outlook continues to worsen, according to a monthly survey.

On average, bankers expect holiday sales in their area to increase by 5.7% from the same period last year, according to the most recent

Rural Mainstreet Index, a monthly survey of bank CEOs in rural parts of 10 states.

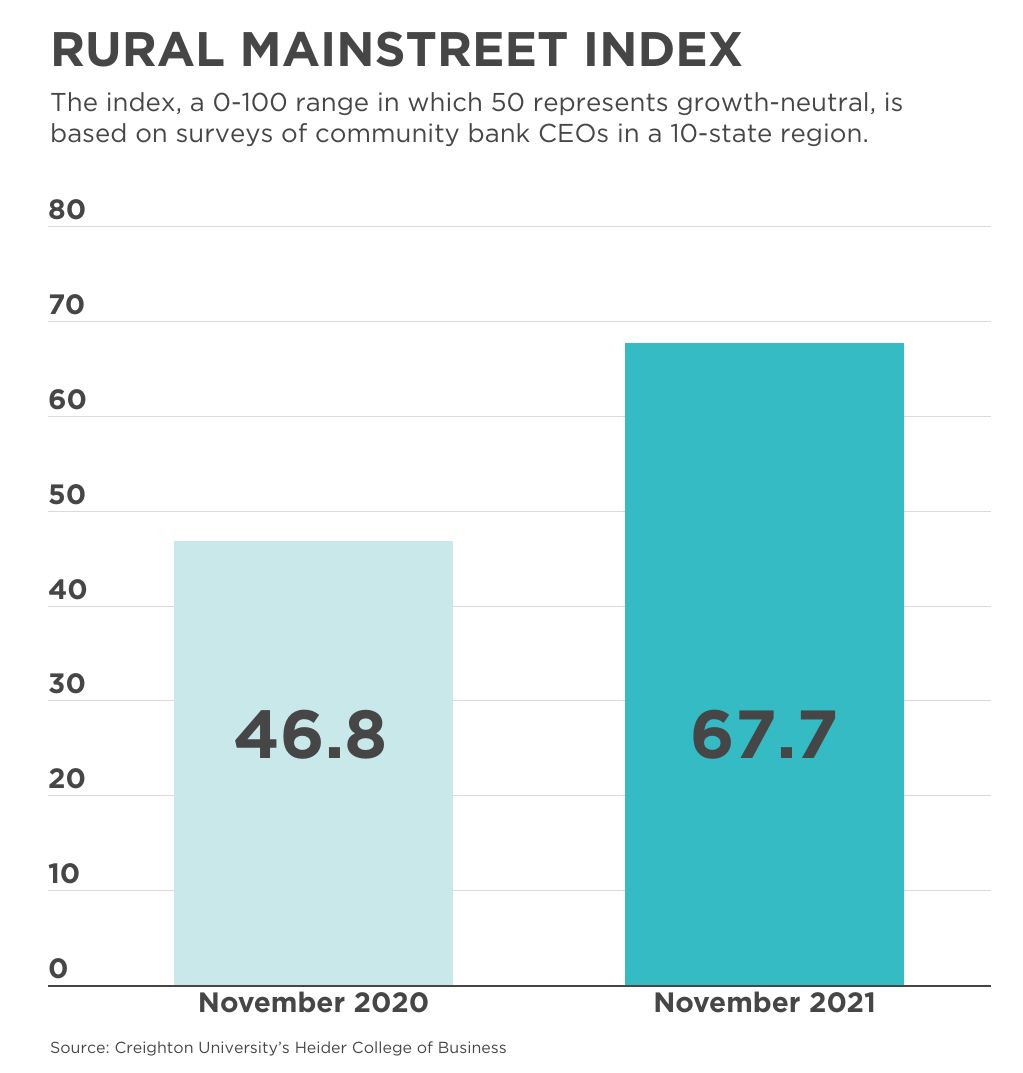

The overall index, which gauges bankers’ real-time assessment of the rural economy, remained above growth-neutral for the 12th straight month, rising to 67.7 in November from October’s 66.1. It ranges from 0 to 100, with 50.0 representing growth neutral.

Creighton University economist Ernie Goss, the study’s author, said the region is benefiting from solid grain prices, continued record-low interest rates and growing agricultural exports.

Data from the U.S. Department of Agriculture show that 2021 year-to-date agriculture exports are 25.4% higher than the same period in 2020, Goss noted.

However, the survey’s confidence index, a six-month outlook of bank CEO expectations for the economy, sank for the fifth straight month to 48.4, its lowest level since August 2020 and down from October’s 51.8.

About one-third of the bank CEOs surveyed “expect the recently passed infrastructure bill to have more negatives than positives for agriculture,” the report said.

Meanwhile, November’s farmland price index soared to a record-high 85.5 from October’s 81.5. The farm equipment-sales index slipped to a still-strong 62.1 this month from 64.8 in October.

“Readings for farmland prices and equipment sales over the last several months represent the strongest consistent growth since 2012,” said Goss.