[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

A monthly survey of rural bankers saw a significant dip in their expectations for the economy six months out, due to Russia’s invasion of Ukraine, global trade tensions and surging inflation.

In the latest

Rural Mainstreet Index, a 10-state survey of community bank presidents and CEOs, the confidence index fell to 39.1 from March’s 54.0. The index ranges from 0 to 100, with 50.0 representing growth neutral.

April’s reading was the lowest since May 2020, when the confidence index hit its all-time low of 22.1 shortly after the pandemic began.

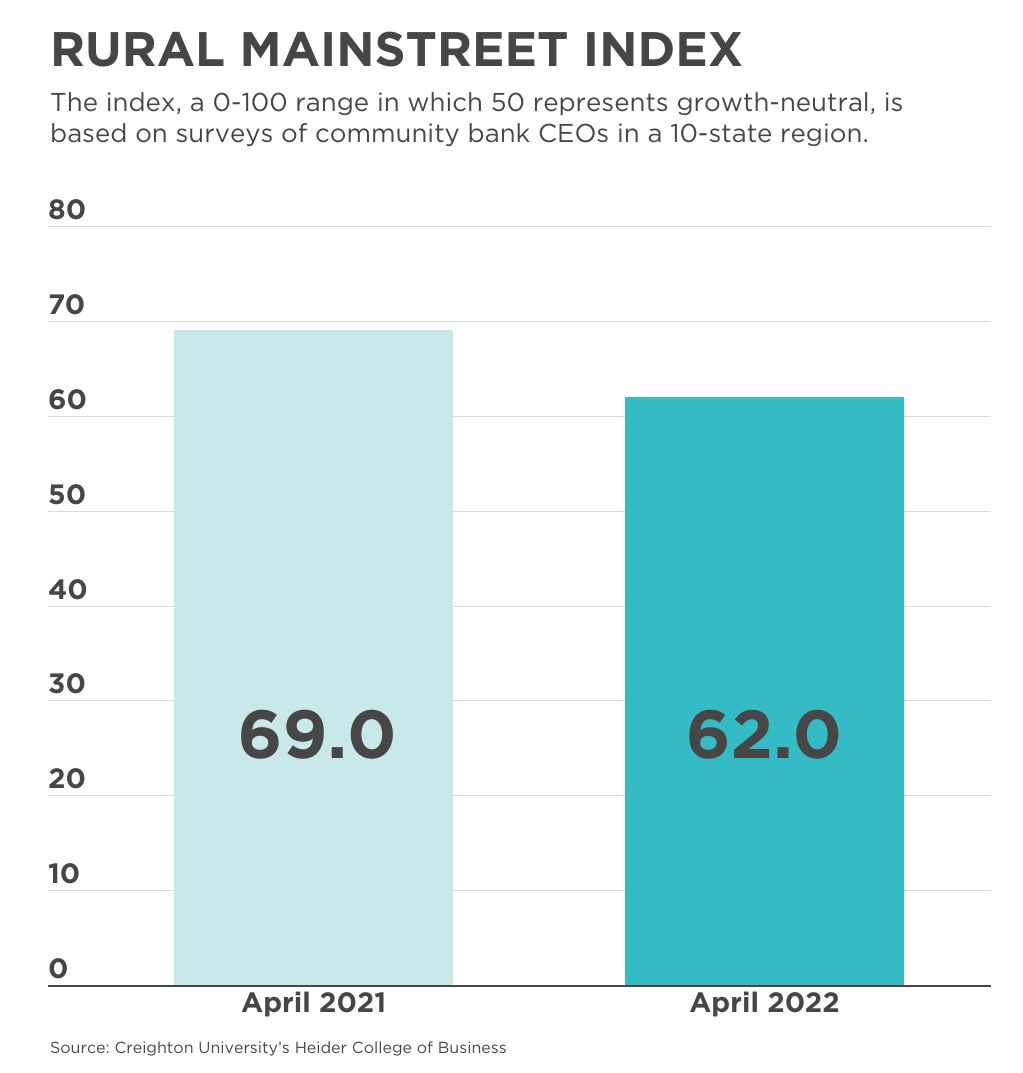

Meanwhile, bankers’ real-time assessment of the rural economy remained above growth-neutral for the 17th straight month, dipping to 62.0 in April from March’s 65.4.

“The region recorded a 34% gain in farm commodity prices over the past 12 months, but low short-term interest rates and healthy farm income have underpinned the rural Mainstreet economy,” said study author Ernie Goss, a Creighton University business school professor.

This month, bankers were asked to forecast the impact of President Joe Biden’s decision to lift the summer production ban gasoline that uses a 15% ethanol blend, or E15 ethanol. Nearly 40% expect the move to have a positive impact, more than half expect little or no impact, and the remaining 4.4% anticipate a negative impact.

The survey also indicates that farmers are wading into cryptocurrency transactions. Bankers estimated that about 2.3% of farmers have conducted business using the digital currency in the past 12 months.

The survey’s new-hiring index inched up to 64.0 from 63.5 in March, an indication that labor shortages continue to constrain growth in rural areas.

Overall, though, federal data show that gains in nonfarm employment in rural areas have been higher than in urban areas over the past 12 months, at 4.5% compared to 3.1%.