[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

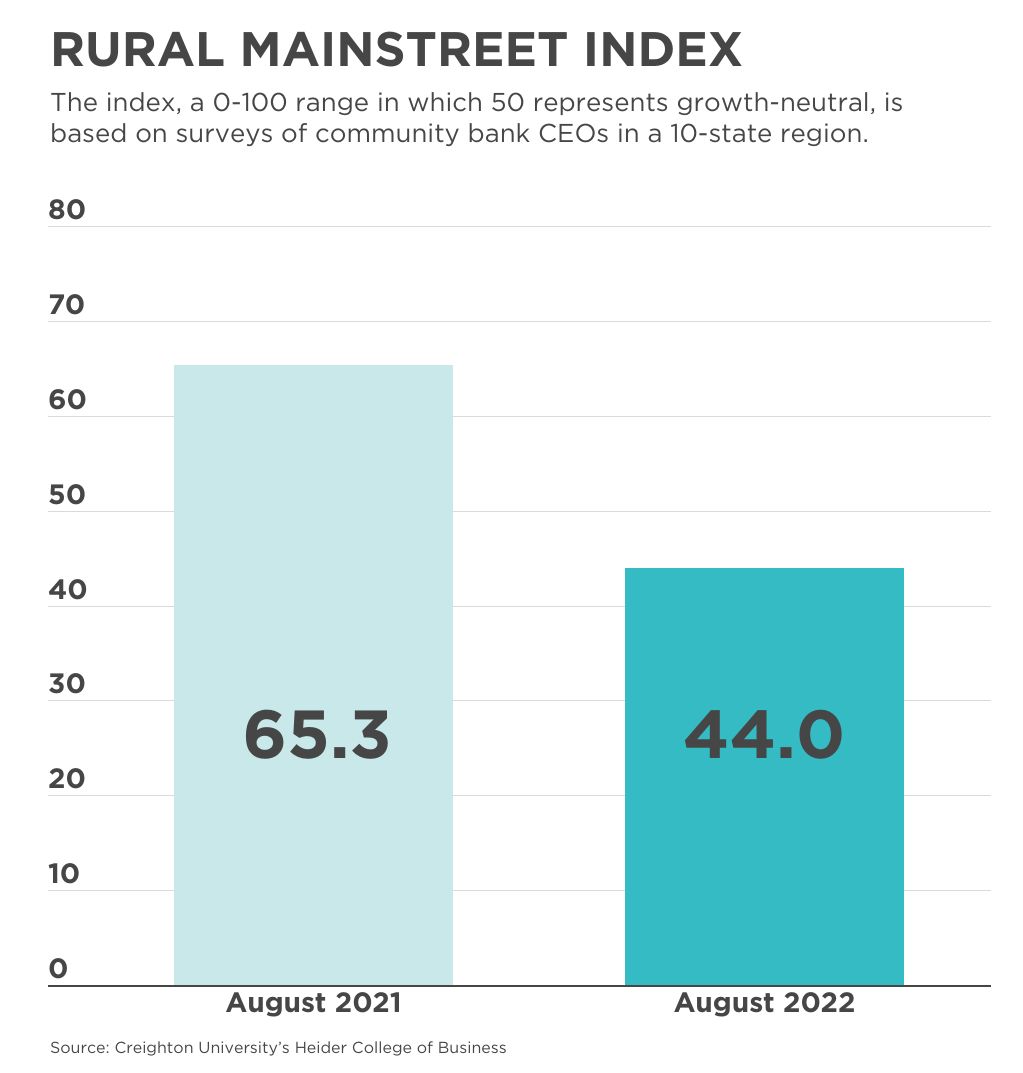

The rural economic downturn is showing no signs of abating, according to an August survey of bankers.

The

Rural Mainstreet Index, which gauges bankers’ real-time assessment of the economy, fell for a fifth straight month. August’s reading of 44.0 also marked the third consecutive month of a below-growth-neutral reading.

In the survey of community bank presidents and CEOs in 10 states, the index ranges from 0 to 100, with a reading of 50.0 representing growth neutral.

“Supply chain disruptions from transportation bottlenecks and labor shortages continue to constrain growth. Farmers and bankers are bracing for escalating interest rates and falling farm commodity prices,” said Creighton University business school professor Ernie Goss, the study’s author.

August’s new hiring index fell to 52.0 from 60.9 in July. However, non-farm employment among rural and urban businesses in the survey’s 10-state area expanded by 3.4% over the past 12 months.

This month’s readings related to farming and ranching were particularly gloomy. More than nine in 10 bankers regard overseas purchases of regional farmland and food processing facilities as threats to their regional economies.

And sales of farming equipment fell to their lowest levels in two years—45.9 in August from July’s 56.5.

“After 20 straight months of advancing above growth neutral, the index unexpectedly dropped below the threshold to its lowest level since November 2020,” the report said.

This month’s readings for home and retail sales were also disappointing. The home-sales index dropped to 44.0 from July’s 48.0, while the retail-sales index ticked slightly upward to 48.0 from July’s 46.0—but was still below growth neutral.

“Rising energy prices and higher interest rates reduced home and retail sales on Rural Mainstreet. This is the lowest home sales index since December 2018,” said Goss.

The slowing economy and high prices for energy and farming supplies continued to drag down the confidence index, which reflects bank CEO expectations for the economy six months out. The confidence index was 38.0 in August—an improvement over July’s 26.0 but still far below growth-neutral.