[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

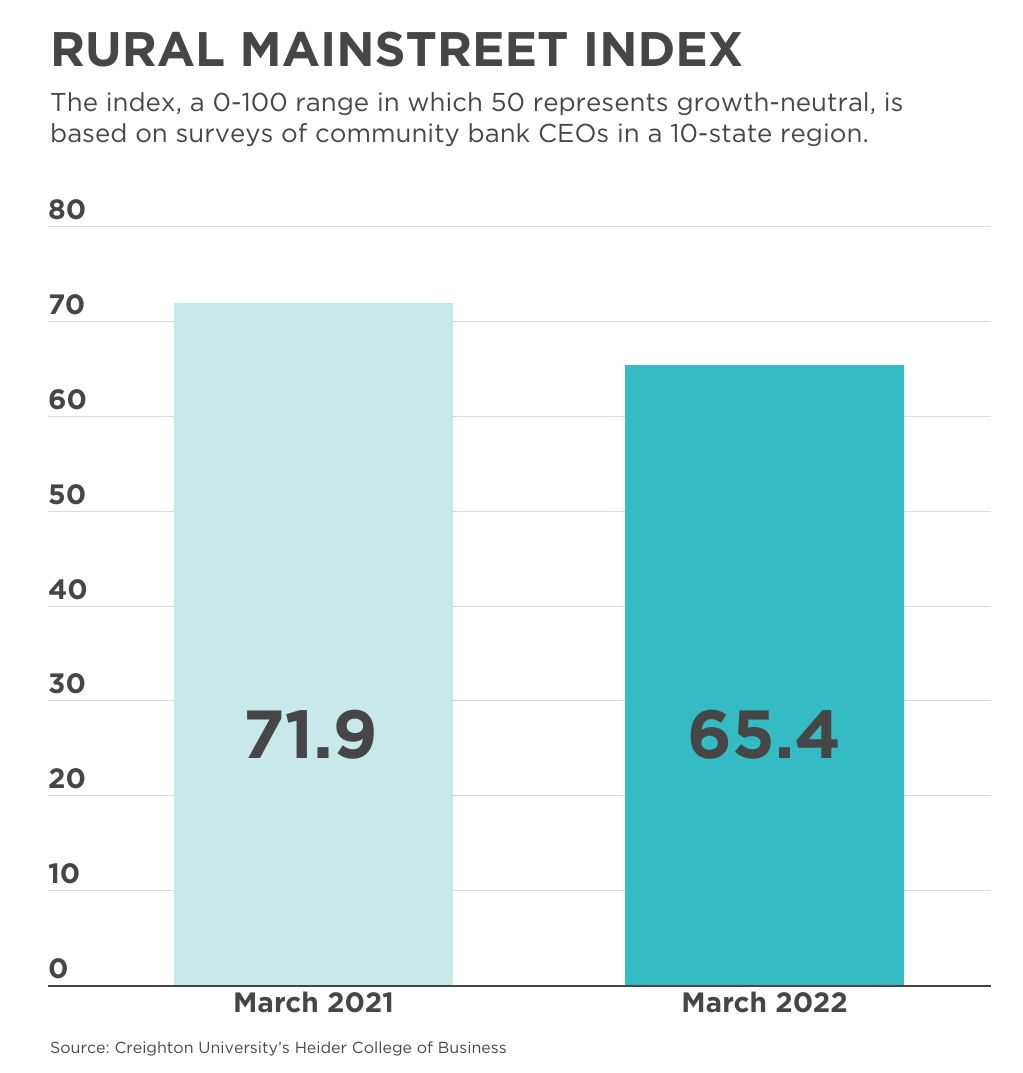

The rural economy continues to grow, but bankers are concerned about repercussions from Russia’s invasion of Ukraine, according to a monthly survey.

In the latest

Rural Mainstreet Index, a 10-state survey of community bank presidents and CEOs, the real-time assessment of the rural economy rose to 65.4 in March from February’s 61.5. The index ranges between 0 and 100, with a reading of 50.0 representing growth-neutral.

Creighton University business school professor Ernie Goss, the study’s author, attributed the strong reading to a 25% gain in farm commodity prices over the past year, near-record-low short-term interest rates and growing agriculture exports.

The survey was released one day after the Federal Reserve announced a half-point rate hike and scheduled more increases by the end of the year to slow inflation.

The confidence index, which reflects bank CEO expectations for the economy six months out, advanced to 54.0 for March, up from February’s 51.9. At the same time, however, about six of 10 bankers “project negative fallout for farmers from Russia’s invasion of Ukraine.”

This month, farm equipment sales remained strong, moving slightly upward to 72.2 from 72.0 in February. It’s the 16th straight month of gains and the longest streak of above-growth-neutral readings since 2011-2013.

The region’s farmland price index dipped to 78.0 from February’s 78.8. March’s reading represented the 18th straight month that the index has been above growth neutral.

Even with higher costs for fertilizer and other farm supplies, 42.3% of bank CEOs expect 2022 net farm income to expand from 2021’s healthy level; 11.5% of bankers expect lower net farm income, while 46.2% expect no change.

Nearly 40% of the bankers surveyed believe Russia’s invasion of Ukraine will have negative impacts on net farm income with livestock producers hit harder than grain producers.