[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

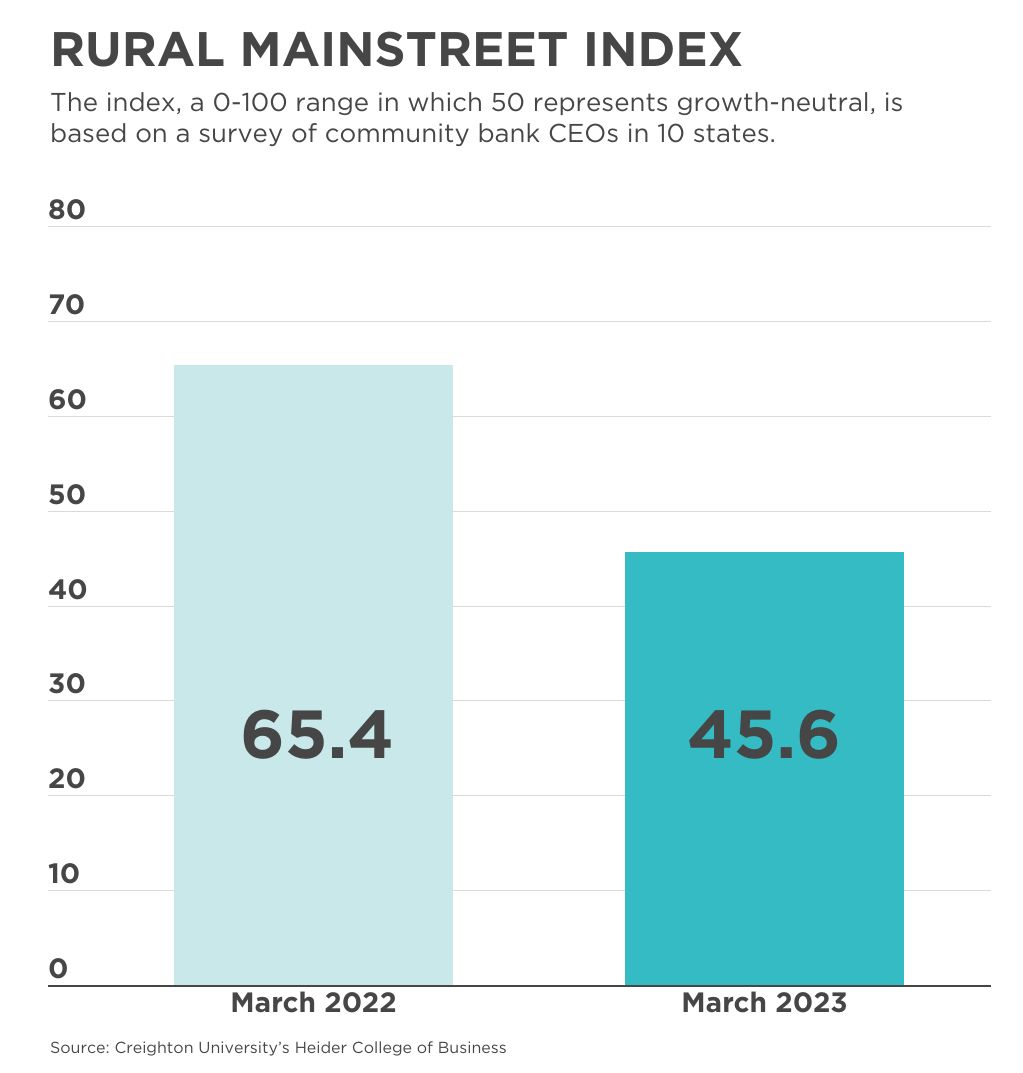

After three months of hovering just over the growth-neutral mark, rural bankers’ monthly assessment of the economy has gone negative.

The overall

Rural Mainstreet Index dropped to 45.6 this month from 50.1 in February. In the survey of rural bankers in 10 states, the index ranges from 0 to 100 with a reading of 50.0 representing growth-neutral.

This month’s reading is the lowest since last October, said study author Ernie Goss, a business professor at Creighton University in Omaha, Nebraska.

“Less than 1% of bankers reported improving economic conditions for the month, with 92% indicating no change in economic conditions from February’s slow growth,” Goss said.

Rural hiring and home sales continued to fall this month. The new hiring index for March dropped to 45.5 from last month’s 48.1, “as labor shortages continue to be a significant issue constraining growth for Rural Mainstreet businesses,” the report said.

And while the decline in the home sales index was small this month—36.4 compared to February’s 37.0—it marked the 10th consecutive month of a downward trend.

“An almost doubling of the 30-year mortgage rate over the past year and low inventory levels slowed home sales in the region over that time period,” Goss said.

The retail sales index took a dive in March, dropping to 41.3 from February’s 50.0. And after farmland prices rose 9% over the past year, bankers expect them to expand by only 1% over the next 12 months.

All combined, the slowing economy, higher borrowing costs and labor shortages lowered the confidence index, which reflects bankers’ economic projections six months out. This month, the reading was 39.1, compared to 44.4 in February.