[section]

[section-item]

[row]

[column 12]

[/column]

[/row]

[/section-item]

[/section]

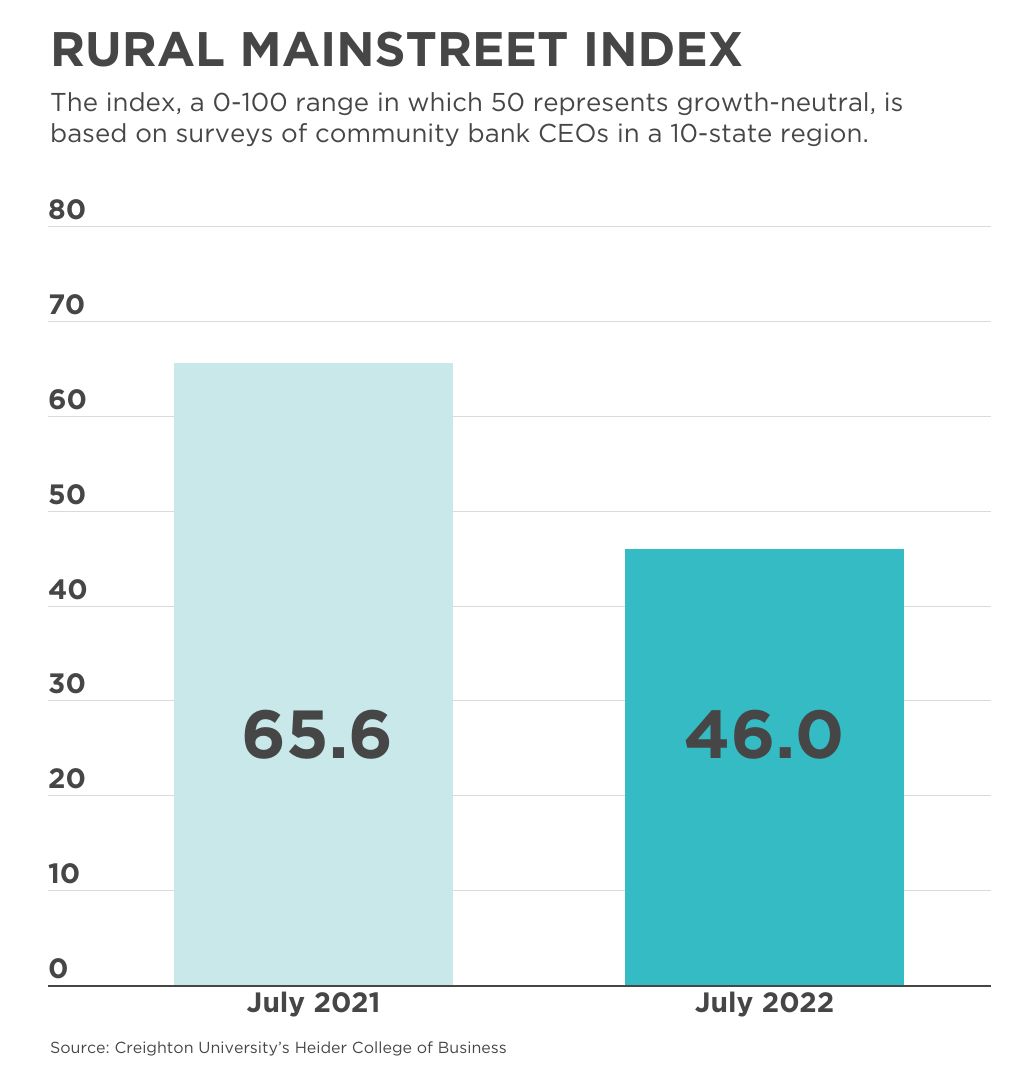

The rural economy is in the midst of a slump, according to a July survey of bankers.

In the latest

Rural Mainstreet Index, two indicators have hit lows not seen since the pandemic's early months:

The confidence index, which gauges bankers’ expectations for the economy six months out, slid to 26.0 from 33.9 in June—the lowest back-to-back readings since April and May 2020.

The overall index, which gauges bankers’ real-time assessment of the rural economy, fell to 46.0 from June's 49.8, the fourth straight month of declines.

In the survey of community bank presidents and CEOs in 10 states, the index ranges from 0 to 100, with a reading of 50.0 representing growth neutral.

“The rural economy is now experiencing a downturn in economic activity,” said study author Ernie Goss, a business professor at Creighton University in Omaha, Nebraska. “Supply chain disruptions from transportation bottlenecks and labor shortages continue to constrain growth. Farmers and bankers are bracing for escalating interest rates—both long-term and short-term.”

Those factors, combined with high prices for energy and farming supplies and equipment, are resulting in diminished confidence among bankers, according to the report.

This month’s survey asked bankers to identify the greatest risk for farmers over the next 12 months. They cited rising prices for farming supplies and equipment (53.9%), falling grain and livestock prices (34.6%) and continuing drought (11.5%).

“It’s the combination of higher input costs and a potential fall in commodity prices that are the biggest risks to farmers,” said James Brown, CEO of Hardin County Savings Bank in Eldora, Iowa.

Also on a downward slope are home and retail sales. The home-sales index dropped to 48.0 from June’s 55.4; the retail-sales indicator fell to 46.0, compared to June’s 48.2. Higher interest rates and rising energy prices were contributing factors.

“This is the lowest home sales index since January 2019, and first back-to-back below growth-neutral readings for the retail index since January-February 2021,” said Goss.