The United States is changing the way it calculates interest rates for mortgages, car payments, credit cards and more. By the end of 2021, after decades of interest rates based on the London Interbank Offered Rate (LIBOR), the country is planning to transition to the Secured Overnight Financing Rate (SOFR), administered by the Federal Reserve Bank of New York.

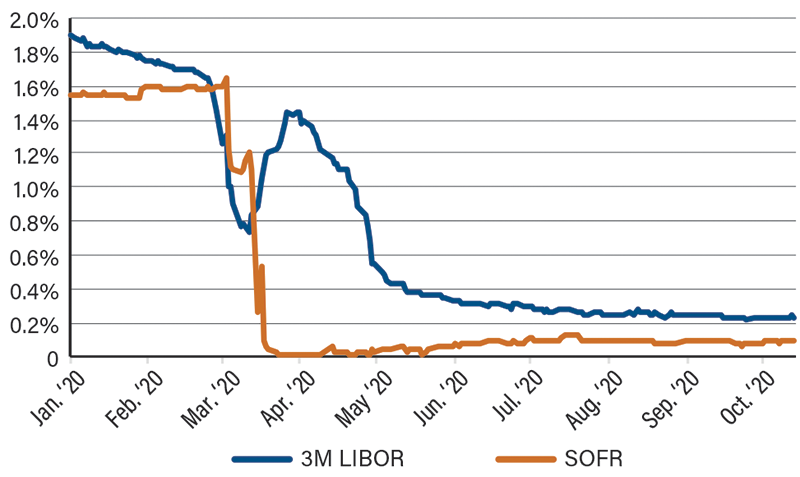

Why SOFR? SOFR is already used by financial institutions and central banks to borrow funds and conduct monetary policy. The transition away from LIBOR should be a good thing because SOFR is better attuned to market fluctuations since the rate is calculated from actual transactions, which exceed $1 trillion in value daily. Observations amid the COVID-19 pandemic indicate the index appeared to mirror market conditions and react faster during a very uncertain environment.

The transition will impact outstanding LIBOR-based financial products in two significant ways. First, the benchmark rate will change from an unsecured rate (LIBOR) to a secured, risk-free rate (SOFR). Any time you compare a secured rate with an unsecured rate, there is a market spread that differentiates the two since a secured rate will trade below an unsecured rate on like-rated securities. Moreover, the switch will require a term adjustment from LIBOR (a term rate) to SOFR (an overnight rate). These changes will require an “index” spread adjustment applied to SOFR, in addition to any current spread on variable-rate loans. Second, SOFR is a daily backward-looking overnight rate compared with LIBOR being a forward-looking term rate. Unless a variation of SOFR is used, rate resets will be calculated using daily rates throughout the interest rate period, with the final calculated rate not known until closer to the payment date.

While change can be frustrating, the impact to cooperatives is expected to be minimal. CFC created a LIBOR Working Group comprising employees from Legal, IT, Member Services and Treasury business groups in 2019. By staying abreast of market developments and relevant industry research, the Working Group will help guide members through a smooth and orderly transition.

For more information on what this means for CFC members, catch a replay of CFC’s October 26 Extra Credit Educations Series webinar on “LIBOR Transition: What Cooperatives Should Know.” The replay is available on the CFC Member Website under Events & Training.

[button new-window title="Watch%20the%20LIBOR%20Transition%20Webinar%20Replay" link="https%3A%2F%2Fportal.nrucfc.coop%2Fcontent%2Fcfc%2Fevents%2Fpast_events%2Fpast-webinars.html" /]

Benchmark Interest Rates: LIBOR vs. SOFR