CFC recently published the 2019 G&T Key Performance Indicators (KPI) Report following the delay in collecting 2019 Form 12 filings due to the pandemic. The annual benchmarking report contains more than 200 generation and transmission (G&T) cooperative financial and operating ratios, along with credit rating influencers and 11 peer group comparisons.

“We appreciate and thank our members for sharing the data required to generate the KPI Report and are confident it will offer valuable insight to assist them with their strategic and business planning needs,” CFC Senior Manager of Financial Products and Analysis Bettina Kimmel said. “Median key performance indicators for the 53 reporting G&Ts remain strong. Regardless of the decline in sales in 2019, G&Ts continue to maintain strong coverage ratios and stable equity positions.”

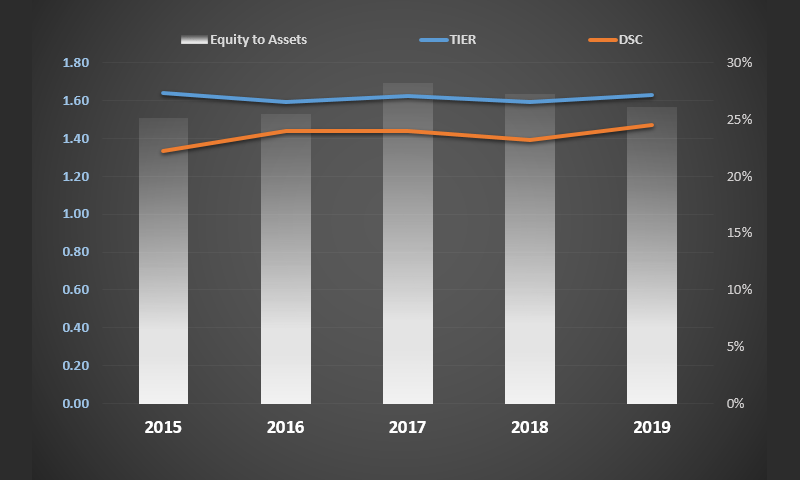

G&T Coverage Ratios Improved Despite Energy Sales Decline

G&Ts experienced a 1.25 percent decline in energy sales in 2019 compared with record-breaking 2018 energy sales that climbed 6.25 percent. Distribution cooperatives mirrored the performance of the G&Ts’ drop in energy sales of 1.32 percent in 2019 as reported in the Key Ratio Trend Analysis (KRTA).

Nuclear generation saw significant increases in 2019 as reported by G&T cooperatives. This aligns with the Energy Information Administration (EIA) report that 2019 was the highest year on record for nuclear energy production.

G&T coverage ratios also improved. Times interest earned ratio (TIER) increased to 1.63 in 2019 from 1.59 in 2018 and debt service coverage (DSC) increased to 1.47 for 2019 from 1.39 in 2018. Equity to Assets slightly declined to 26.03 percent in 2019 from 27.23 percent in 2018.

Individual KPI reports were recently e-mailed to G&T CEOs and CFOs. For questions, contact your regional vice president or Kimmel at bettina.kimmel@nrucfc.coop.