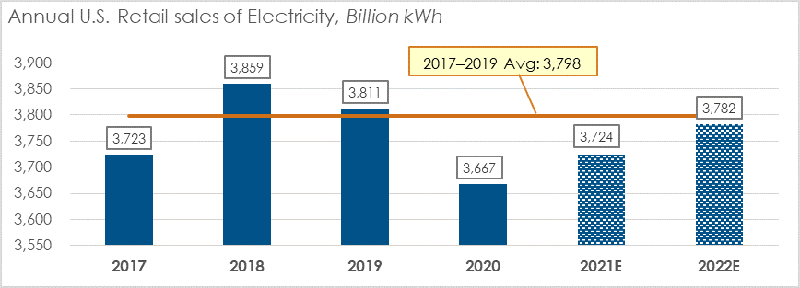

The U.S. Energy Information Administration (EIA) Short-Term Energy Outlook reported total U.S. retail electric sales declined 3.8 percent year-over-year (YoY) in 2020 and were 3.4 percent below the previous three-year average. The primary drivers for the decline were a mild winter and economic decline related to the response to the COVID-19 pandemic. An expected improving economy in 2021, reflected by expectations of 4.2 percent annual gross domestic product growth, should lead to increased total energy use this year. Along with a forecast for colder winter weather driving increased heating load, the EIA expects total retail sales to increase 1.6 percent (YoY) in 2021.

“EIA’s latest data, as well as the future electricity sales projections, reflect caution due to the latest winter COVID-19 surge, but nonetheless show a marked improvement over assessments made during last summer’s pandemic related business disruptions,” CFC Energy Industry Analyst Bijan Patala said. “Cooperatives have responded well to business disruptions created by the pandemic and incorporated revised operating procedures and prudent mitigation measures to meet the challenges of 2020, while continuing to provide safe, reliable and affordable electricity to their members.”

Mild Winter and Pandemic Business Disruptions Cause Retail Sales Decline

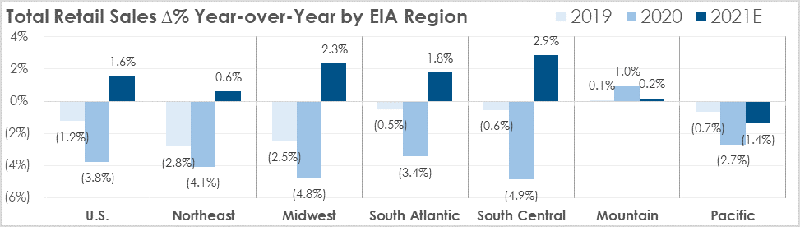

Most geographic regions experienced an annual decline in total retail sales in the range of 3.5 percent to 5.0 percent. Decline differences were due to both varying weather patterns and also varied actions among states toward economic restrictions. The Mountain and Pacific regions, which had more resilient electric demand in 2020 than other regions, saw significantly elevated cooling degree days this summer and experienced periods of record-high temperatures.

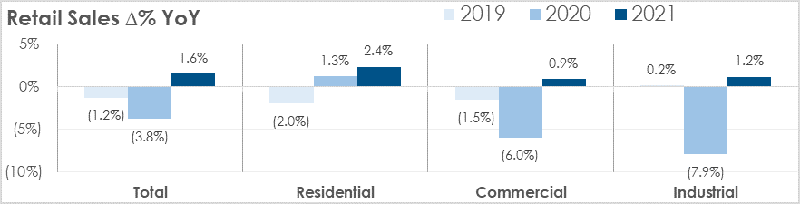

Residential Retail Electric Sales Increased in 2020

Residential retail electric sales in 2020 increased 1.3 percent YoY. This customer class showed resilience as government-ordered lockdowns and adherence to social distancing recommendations led to people spending more time in their homes, including a large portion of the population switching to remote work. For second quarter 2020, which represented the height of economic lockdowns, residential sales were 7.5 percent above the same period the previous year. This was partially offset by a mild winter, depressing first-quarter 2020 heating demand. U.S. average heating degree days in 2020 declined 9.8 percent YoY.

The public response to the pandemic applied significant downward pressure on retail electric sales to the commercial and industrial classes, which declined 6.0 percent and 7.9 percent, respectively.

Renewed Economic Activity to Drive Retail Electric Sales Increase in 2021

In 2021, retail electric sales to residential, commercial and industrial customers are expected to increase 2.4 percent, 0.9 percent and 1.2 percent, respectively. These projections reflect an improving economy, but with continued government-ordered restrictions on economic activity capping further growth.

Natural Gas Prices to Increase Wholesale Electric Prices in 2021

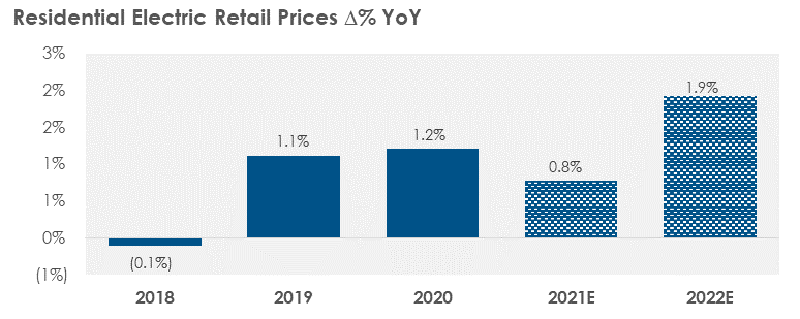

Retail electric prices to residential customers increased 1.2 percent in 2020. This likely reflects the growth in electric demand from this class, as wholesale electricity prices were significantly lower in 2020 for the majority of the country. In contrast, retail electric prices to commercial and industrial customers declined 0.5 percent and 1.9 percent, respectively. Retail electric prices for all customer classes are expected to increase modestly in 2021, around 1 percent, reflecting expectations for rising wholesale electric prices in 2021. The forecasted increase is due to climbing natural gas prices, which were at their lowest levels in at least 23 years in 2020.

Electric Cooperatives Are Resilient Despite Pandemic Disruptions

COVID-19 related electric demand declines affected individual cooperatives differently, mainly depending on declines in their commercial and industrial mix. Businesses that were hardest hit by the pandemic, particularly the hospitality and travel industries, have seen formidable downward pressure on electric demand. Cooperatives have been partially insulated to demand declines relative to other utility types due to their higher residential sales mix. Notably, S&P Global Credit Ratings currently has a stable view for the public power and cooperative utilities sector and states that nearly all of this sector’s utilities are displaying resilience in the face of pandemic disruptions.