The markets have been spoiled with extremely low interest rates since 2008, but could that be changing? While many economists believe the outlook for low rates hasn’t shifted, there does seem to be increased chatter that inflation may reappear in 2021 due to several growth drivers—and rising inflation usually triggers rising interest rates.

We’re Doing Better Than Expected

The International Monetary Fund recently improved its growth estimate for the U.S. economy, predicting 5.1 percent growth this year instead of 3.1 percent. One of the biggest drivers behind the change is federal fiscal relief. The $900 billion package passed in December has not had time to fully work its way through the economy, and yet the new administration is working on another fiscal stimulus plan that could be twice as big. Most economists feel it is desperately needed as the great American labor machine has sputtered lately, adding only 49,000 nonfarm payroll jobs in January.

Another big economic kick could come from stockpiled consumer savings. If Americans are staying home, they’re not out and about spending their disposable income. The total accumulated savings figure is estimated at $1.6 trillion. A confident consumer armed with a pocket full of money is a powerful force and contributes more than 70 percent of the U.S. economic growth. The vaccine rollout and continued success in pushing back the virus will quicken this process, though the windfall is expected in the second half of the year.

The last positive component could be trade. Even though the Biden administration is likely to leave Trump-era tariffs in place, the U.S.-China global trading regime is expected to improve, which will allow the industrial, manufacturing and commodity recovery cycle to proceed smoothly.

What Happens When the Demand Returns?

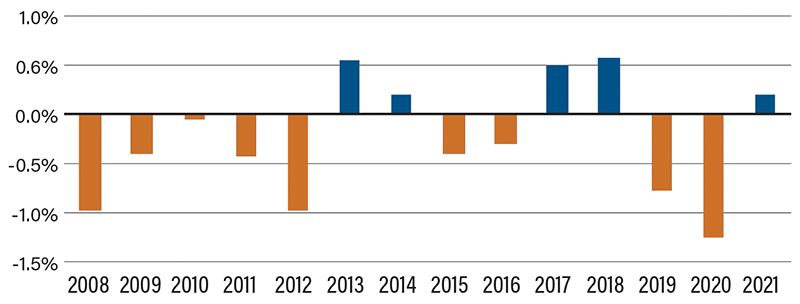

These key growth drivers are expected to have an impact on the prices of goods and services here at home. When demand outstrips supply, prices begin to rise. Bond investors will take note and start requiring higher interest rates on government Treasury purchases—such as the recent 25-basis-point rise on the yield for a 10-year Treasury. That uptick and the outlook for strong growth in the second half of 2021 could mean we might not be spoiled for as long as we thought.

10-Year Treasury Yield